ETC Announces Fiscal 2024 Third Quarter Results

SOUTHAMPTON, PA, USA, January 12, 2024 – Environmental Tectonics Corporation (OTC Pink: ETCC) (“ETC” or the “Company”) today reported its financial results for the thirteen week period ended November 24, 2023 (the “2024 third quarter”) and the fiscal first three quarters ended November 24, 2023.

Robert L. Laurent, Jr., ETC’s Chief Executive Officer and President stated, “We are extremely pleased with the overall 58% increase in third quarter sales versus prior year, as well as our return to profitability with net income of $0.5 million compared to a loss of $0.8 million versus the prior year. At the same time, bookings remain strong increasing 108% in the third quarter when compared to prior year. This has increased our backlog 383% from the prior year to the current $114.5 million. This continued acceleration in sales and increased backlog, along with a solid pipeline of opportunities, position us well moving forward.”

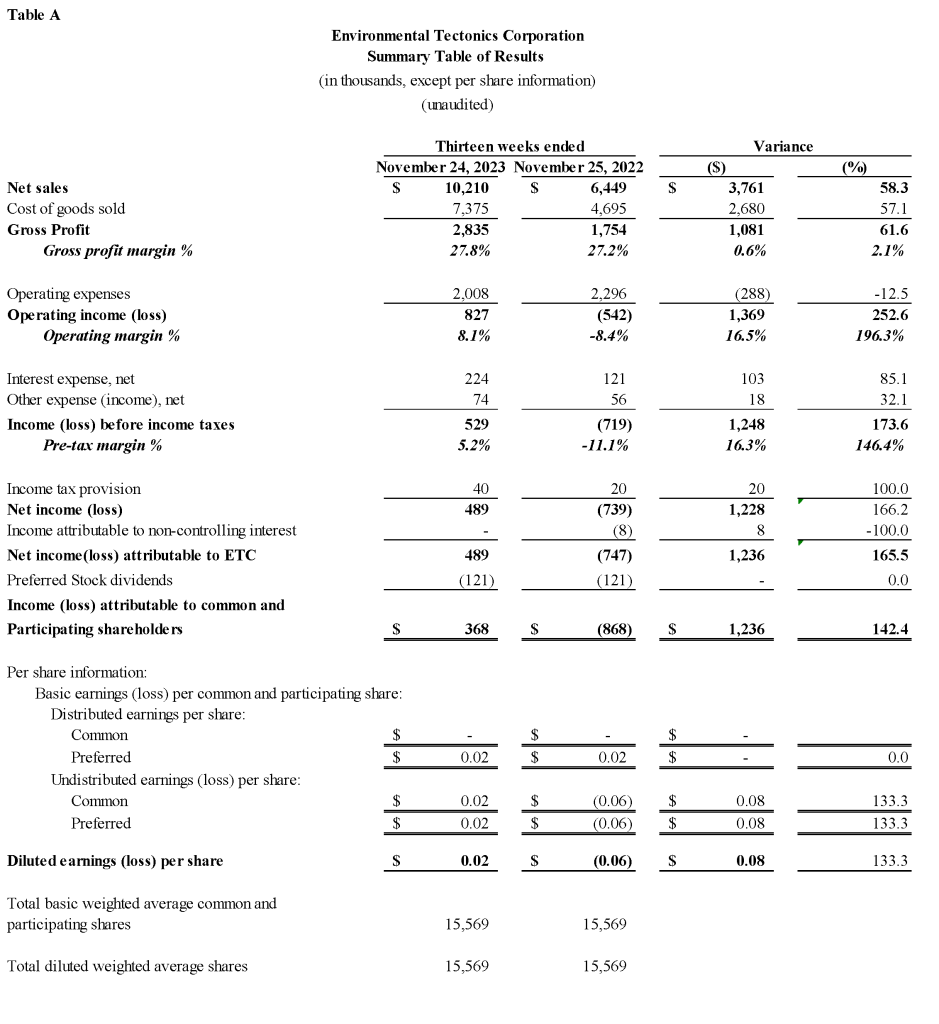

Fiscal 2024 Third Quarter Results of Operations

Net Income (Loss) Attributable to ETC

Net income attributable to ETC was $0.5 million, or $0.02 diluted earnings per share, in the 2024 fiscal third quarter, compared to net loss attributable to ETC of ($0.8) million during the 2023 fiscal third quarter, equating to ($0.06) diluted loss per share. The $1.2 million variance is primarily attributable to a $3.8 million increase in revenue as well as a 0.6% increase in gross profit margin percentage.

Net Sales

Net sales in the 2024 fiscal third quarter were $10.2 million, an increase of $3.8 million, or 58.3%, compared to 2023 fiscal third quarter net sales of $6.4 million. The increase in net sales was driven by a $2.8 million or 82.9% increase in aerospace solutions and a $1.3 million or 60.0% increase in sterilizer systems net sales in 2024 fiscal third quarter as compared to 2023 fiscal third quarter net sales. Bookings in the 2024 fiscal third quarter were $13.2 million, which were driven by $9.3 of Aerospace Solutions orders and $3.4 of Sterilizer Systems orders.

Gross Profit

Gross profit for the 2024 fiscal third quarter of $2.8 million increased from $1.8 million in the 2023 fiscal third quarter, an increase of $1.1 million or 61.6%. Gross profit margin percentage of 27.8% for the 2024 fiscal third quarter represented an increase of 0.6% as compared to 27.2% in the 2023 third fiscal quarter. The increase in gross profit was mainly due to the increase in sales as well as the improved gross profit margin percentage.

Operating Expenses

Operating expenses, including sales and marketing, general and administrative, and research and development, for the 2024 fiscal third quarter were $2.0 million, a decrease of $0.3 million, or (12.5%), compared to $2.3 million for the 2023 fiscal third quarter. The decrease in operating expenses was due primarily to lower research and development costs of $0.2 million in the 2024 fiscal third quarter compared to the 2023 fiscal third quarter.

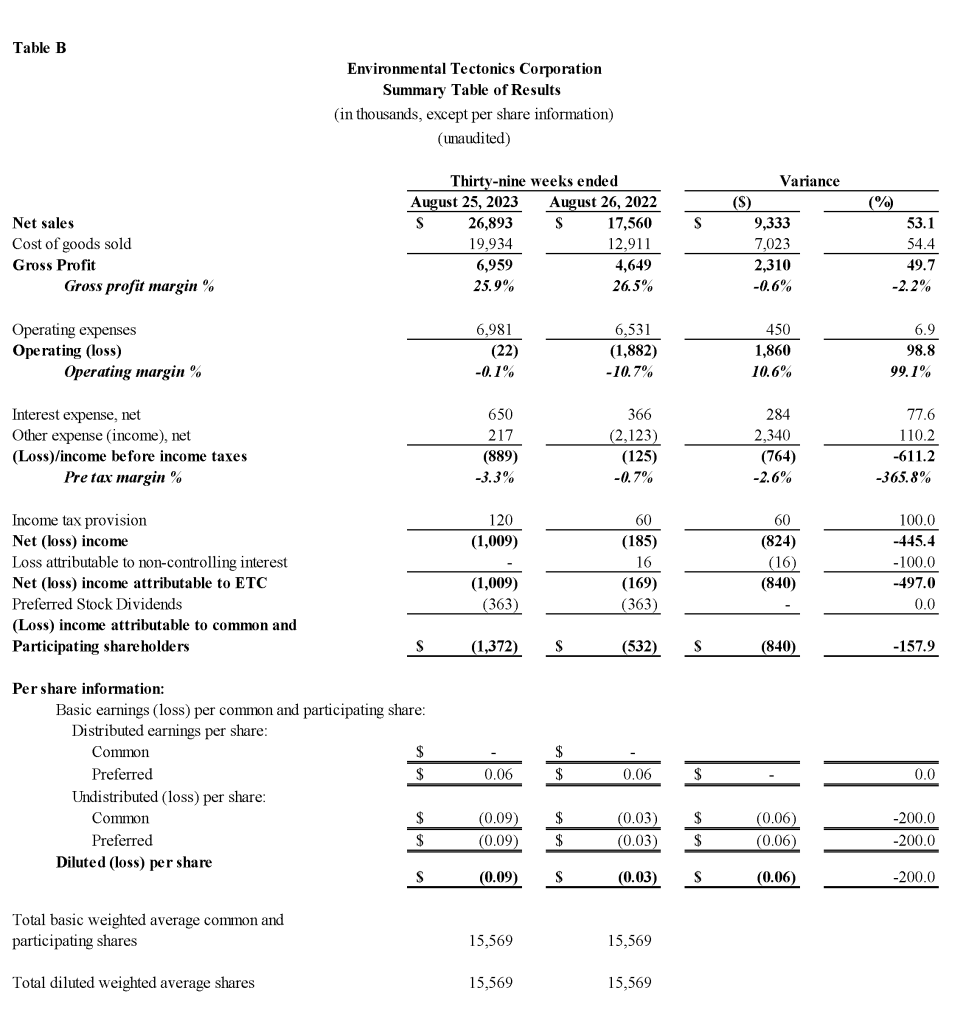

Fiscal 2024 First Three Quarters Results of Operations

Net (Loss) Attributable to ETC

Net loss attributable to ETC was ($1.0) million, or ($0.09) diluted loss per share, in the 2024 fiscal first three quarters, compared to net loss attributable to ETC of ($0.2) million during the 2023 fiscal first three quarters, equating to ($0.03) diluted loss per share. The ($0.8) million variance is due primarily to the effect of a gain on the sale of the facility at 125 James Way, Southampton, PA in the 2023 fiscal first three quarters partially offset by improved operating results in the 2024 fiscal first three quarters.

Net Sales

Net sales in the 2024 fiscal first three quarters were $26.9 million, an increase of $9.3 million, or 53.1%, compared to 2023 fiscal first three quarters net sales of $17.6 million. The increase in net sales is attributable to a $6.4 million or 106.0% increase in Aircrew Training Systems and a $4.7 million or 97.9% increase in sterilizer systems 2024 fiscal first three quarters net sales offset in part by a ($1.4) million or (53.3%) decrease in environmental net sales in the 2024 fiscal first three quarters as compared to the 2023 fiscal first three quarters.

Gross Profit

Gross profit for the 2024 fiscal first three quarters was $7.0 million compared to $4.6 million in the 2023 fiscal first three quarters, an increase of $2.3 million, or 49.7%. The increase in gross profit was due to an increase in net sales slightly offset by lower gross profit margin percentage. Gross profit margin of 25.9% for the 2024 fiscal first three quarters represented a decrease of 0.6% compared to 26.5% in 2023 fiscal first three quarters. Gross profit margin percentage was negatively affected during the 2024 fiscal first three quarters as the Company began to ramp up employment early in the year to handle the significant increase in backlog.

Operating Expenses

Operating expenses, including sales and marketing, general and administrative, and research and development, for the 2024 fiscal first three quarters were $7.0 million, an increase of $0.5 million, or 6.9%, compared to $6.5 million for the 2023 fiscal first three quarters. The increase in operating expenses was primarily due to increased expense related to higher sales and personnel expense as the company continues to grow our capacity to deliver on the increasing sales backlog.

Other Expenses (Income), Net

Other expense, net for the 2024 fiscal first three quarters was $0.2 million compared to other income, net of ($2.1) million for the 2023 fiscal first three quarters, an unfavorable variance of $2.3 million, or 110.2%. This is a direct result of the gain on the facility sale of 125 James Way in the 2023 fiscal first three quarters referenced above.

Cash Flows from Operating, Investing, and Financing Activities

During the 2024 fiscal first three quarters, the Company used $6.0 million of cash from operating activities, due primarily from an increase in accounts receivable and prepaid expenses and other assets, slightly offset by an increase in accounts payable and contract liabilities, as compared to providing $1.4 million during the 2023 fiscal first three quarters.

Cash used for investing activities was $0.2 million during the 2024 fiscal first three quarters which primarily related to funds used for capital expenditures on equipment and software development as compared to $4.5 million provided by investing activities during the fiscal first three quarters of 2023 primarily attributable to the facility sale of 125 James Way.

The Company’s financing activities included increased borrowings of $4.3 million during the fiscal first three quarters of 2024 under the Company’s credit facility as compared to using $4.3 million of cash during the 2023 fiscal first three quarters for repayments under the Company’s credit facilities.

Financial Tables Follow

Forward-looking Statements

This news release contains forward-looking statements, which are based on management's expectations and are subject to uncertainties and changes in circumstances. Words and expressions reflecting something other than historical fact are intended to identify forward-looking statements, and these statements may include terminology such as "may", "will", "should", "expect", "plan", "anticipate", "believe", "estimate", "future", "predict", "potential", "intend", or "continue", and similar expressions. We base our forward-looking statements on our current expectations and projections about future events or future financial performance. Our forward-looking statements are subject to known and unknown risks, uncertainties and assumptions about ETC and its subsidiaries that may cause actual results to be materially different from any future results implied by these forward-looking statements. We caution you not to place undue reliance on these forward-looking statements.