ETC Announces Fiscal 2023 Third Quarter Results and Board of Director Appointment

SOUTHAMPTON, PA, USA, January 9, 2023 – Environmental Tectonics Corporation (OTC Pink: ETCC) (“ETC” or the “Company”) today reported its financial results for the thirteen week period ended November 25, 2022 (the “2023 third quarter”) and the thirty-nine week period ended November 25, 2022 (the “2023 first three quarters”).

Robert L. Laurent, Jr., ETC’s Chief Executive Officer and President stated, “We are pleased with the 45% increase in sales in the third quarter over the prior year period, which reflects sales increases of 123% in ETC’s Commercial Industrial Segment and an 11% increase in Aerospace. The strength of our increasing backlog and opportunities in the pipeline are driving sales and margin increases.”

Board of Director Appointment

ETC also announces the appointment of Brian J. Eccleston to its Board of Directors, to fill a vacancy on the Board.

Mr. Eccleston is CFO and Partner at GranitRidge Asset Management LP. Prior thereto, Mr. Eccleston was with BDO USA, LLP for twenty-eight years in increasing roles of responsibility. Most recently, Brian served as Managing Partner, North East Region (Assurance and Tax) and as a Member of the BDO USA Board of Directors. Prior thereto, Brian was New York Managing Partner, Assurance Services; Philadelphia Managing Partner, Assurance Services, and; Assurance Partner, NY Metro Practice.

George K. Anderson, ETC’s Chairman, stated, “I am very pleased that Brian has agreed to join our Board of Directors. With his experience and financial background, Brian will be invaluable in helping ETC grow our Aerospace and Commercial/Industrial businesses.”

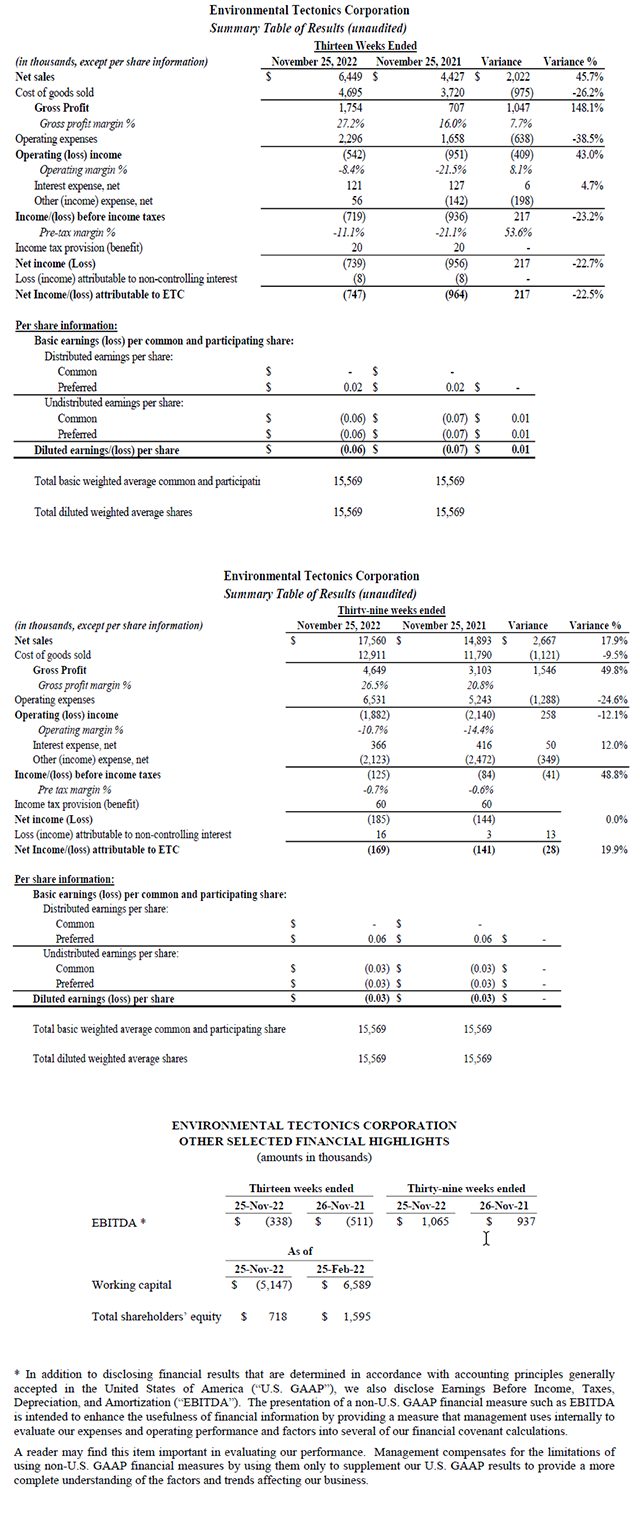

Fiscal 2023 Third Quarter Results of Operations

Net Income (Loss) Attributable to ETC

Net (loss) attributable to ETC was $0.8 million, or ($0.06) diluted earnings per share, in the 2023 third fiscal quarter, compared to net loss attributable to ETC of $1.0 million during the 2022 third quarter, equating to ($0.07) diluted loss per share. The $0.2 million variance is due primarily to the favorable sales mix and improved gross margins.

Net Sales

Net sales in the 2023 third fiscal quarter were $6.4 million, an increase of $2.0 million, or 45.7%, compared to 2022 third quarter net sales of $4.4 million. The increase in net sales was mainly a result of increased output related to the higher YTD CIS orders. CIS sales increased $1.7 million, or 124%, compared to same prior year period. Aerospace sales in 2023 third fiscal quarter accounted for 53% of overall sales, compared to 69% in third fiscal quarter 2022. Further, domestic sales of 45% in 2023 third fiscal quarter were increased from 35% in third fiscal quarter of 2022.

Gross Profit

Gross profit for the 2023 third fiscal quarter of $1.8 million increased from $0.7 million in the 2022 third fiscal quarter, an increase of $1.1 million, or 148.1%. Gross profit margin as a percentage of net sales increased to 27.2% for the third quarter 2023 compared to 16.0% in 2022 third fiscal quarter. The increase in gross profit was a result of successful startup performance with the CIS backlog, as well as a reduction in current costs on International programs.

Operating Expenses

Operating expenses, including sales and marketing, general and administrative, and research and development, for the 2023 third quarter were $2.3 million, an increase of $0.6 million, or 38.5%, compared to $1.7 million for the 2022 third quarter. The increase in operating expenses was due primarily to higher general and administrative expenses, including expenses related to ETC-PZL.

Other Expenses (Income), Net

Other expenses, net, for the 2023 third fiscal quarter was $0.2 million compared to other income of $15 thousand for the 2022 third fiscal quarter, an unfavorable variance of $0.2 million, due primarily to exchange rates fluctuation.

Fiscal 2023 First Three Quarters of Operations

Net Income (Loss) Attributable to ETC

Net (loss) attributable to ETC was ($0.17) million, or ($0.03) diluted earnings per share, in the 2023 first three quarters, compared to net loss of $0.14 million during the 2022 first three quarters, equating to ($0.03) diluted loss per share. The $28 thousand variance is due to the multiple factors, with the largest increase being general and administrative expenses.

Net Sales

Net sales in the 2023 first three quarters were $17.6 million, an increase of $2.7 million, or 17.9%, compared to 2022 first three quarters of $14.9 million. The increase in net sales was due primarily to an increase in CIS domestic sales, driven by the higher orders and backlog. Overall, sales of CIS accounted for 50% of first three quarters of 2023 sales, up from 39% of first three quarters of 2022 sales.

Gross Profit

Gross profit for the 2023 first three quarters was $4.6 million compared to $3.1 million in the 2022 first three quarters, an increase of $1.5 million, or 49.8%. The increase in gross profit was due to the combined effect of an increase in net sales along with increased efficiency gains, compared to the first three quarters of 2022, while the company was still navigating the COVID pandemic. Gross profit margin as a percentage of net sales increased to 26.5% for the 2023 first three quarters compared to 20.8% for the 2022 first three quarters. Cost reduction in multiple International programs was also a major factor in the 2023 YTD increase.

Operating Expenses

Operating expenses, including sales and marketing, general and administrative, and research and development, for the 2023 first three quarters were $6.5 million, an increase of $1.3 million, or 24.6%, compared to $5.2 million for the 2022 first three quarters. The increase in operating expenses was due primarily to higher general and administrative expenses, including expenses related to ETC-PZL.

Other Income, Net

Other income, net for the 2023 first three quarters was $1.8 million compared to other income, net of $2.1 million for the 2022 first three quarters, a decrease of $0.3 million. This is mainly the difference between forgiveness of the PPP loan in 2022 and the facility sale in 2023.

Cash Flows from Operating, Investing, and Financing Activities

During the 2023 first three quarters, due primarily from a decrease in accounts receivable, an increase in customer deposits and the sale of the facility at 125 James Way, the Company provided $1.4 million of cash from operating activities as compared to providing $2.1 million during the 2022 first three quarters.

Cash used for investing activities primarily relates to funds used for capital expenditures of equipment, leased asset and software development. However, as related to ASC 842, the Company’s investing activities generated $4.5 million during the 2023 first three quarters compared to $138 thousand during the 2022 first three quarters.

The Company’s financing activities used $4.3 million of cash during the 2023 first three quarters for repayments under the Company’s credit facilities compared to using $2.6 million of cash during the 2022 first three quarters. This repayment resulted in cash availability of $8.3 million at end of third quarter of 2023.

The Company’s Revolving Line of Credit expires at end of June 2023. Management is in discussion with its lender, and does expect the Line to be renewed prior to expiration.

Financial Tables Follow

Forward-looking Statements

This news release contains forward-looking statements, which are based on management's expectations and are subject to uncertainties and changes in circumstances. Words and expressions reflecting something other than historical fact are intended to identify forward-looking statements, and these statements may include terminology such as "may", "will", "should", "expect", "plan", "anticipate", "believe", "estimate", "future", "predict", "potential", "intend", or "continue", and similar expressions. We base our forward-looking statements on our current expectations and projections about future events or future financial performance. Our forward-looking statements are subject to known and unknown risks, uncertainties and assumptions about ETC and its subsidiaries that may cause actual results to be materially different from any future results implied by these forward-looking statements. We caution you not to place undue reliance on these forward-looking statements.