ETC Announces Fiscal 2023 Second Quarter Results

SOUTHAMPTON, PA, USA, October 10, 2022 – Environmental Tectonics Corporation (OTC Pink: ETCC) (“ETC” or the “Company”) today reported its financial results for the thirteen week

Robert L. Laurent, Jr., ETC’s Chief Executive Officer and President stated, “We are pleased with the overall 19% increase in second quarter sales vs. prior year, and more importantly, with the 466% increase in bookings in the second quarter when compared to prior year. This has increased our backlog 39%, to the current $25.3 million. This increased backlog, along with a solid pipeline of opportunities, position us well moving forward.

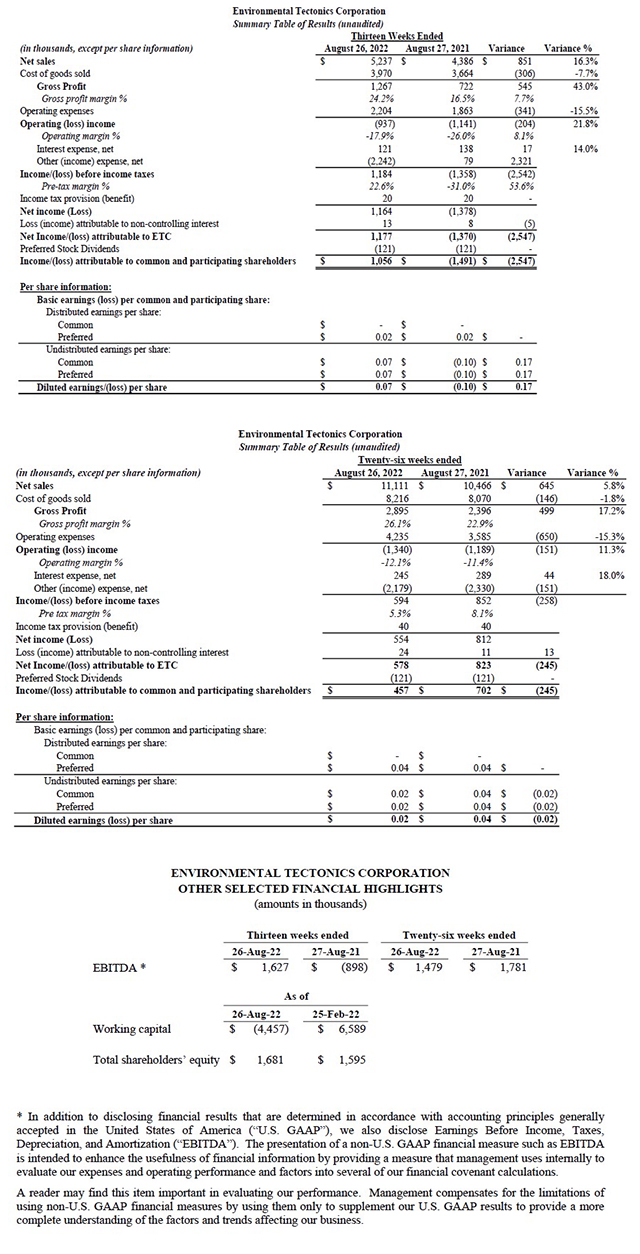

Fiscal 2023 Second Quarter Results of Operations

Net Income (Loss) Attributable to ETC

Net income attributable to ETC was $1.2 million, or $0.07 diluted earnings per share, in the 2023 second fiscal quarter, compared to net loss attributable to ETC of $1.4 million during the 2022 second quarter, equating to ($0.10) diluted loss per share. The $2.6 million variance is due primarily to the effect of proceeds gained on the sale of the facility at 125 James Way, Southampton, PA.

Net Sales

Net sales in the 2023 second fiscal quarter were $5.2 million, an increase of $0.85 million, or 16.3%, compared to 2022 second quarter net sales of $4.4 million. The increase in net sales was mainly a result of increased output related to Environmental contracts in the 2023 second quarter. Aerospace sales in 2023 second fiscal quarter accounted for 58% of overall sales, compared to 61% in second fiscal quarter 2022. Further, domestic sales of 41% in 2023 second fiscal quarter were increased slightly from 39% in second fiscal quarter of 2022. Bookings in the 2023 second fiscal quarter were $15.2 million, which were driven by $10.9 of Sterilizers orders.

Gross Profit

Gross profit for the 2023 second fiscal quarter of $1.3 million increased from $0.7 million in the 2022 second fiscal quarter, while gross profit margin of 24.2% increased by 7.7% compared to 16.5% in 2022 second fiscal quarter. The increase in gross profit was mainly a result of a reduction in expected costs on an International project. This assisted with offsetting some shortfalls in other programs as well.

Operating Expenses

Operating expenses, including sales and marketing, general and administrative, and research and development, for the 2023 second quarter were $2.2 million, an increase of $0.3 million, or 18.0%, compared to $1.9 million for the 2022 second quarter. The increase in operating expenses was due primarily to higher general and administrative expenses, in addition to an increase in expenses related to ETC-PZL.

Other Expenses (Income), Net

Other income, net, for the 2023 second fiscal quarter was $2.2 million compared to other expenses of $79 thousand for the 2022 second fiscal quarter, a favorable variance of $2.3 million. This is directly a result of the facility sale of 125 James Way referenced above.

Fiscal 2023 First Half Results of Operations

Net Income (Loss) Attributable to ETC

Net income attributable to ETC was $0.6 million, or $0.02 diluted earnings per share, in the 2023 first half, compared to $0.8 million during the 2022 first half, equating to $0.04 diluted loss per share. The ($0.2) million variance is due to the higher general and administrative expenses.

Net Sales

Net sales in the 2023 first half were $11.1 million, an increase of $0.6 million, or 5.8%, compared to 2022 first half net sales of $10.5 million. The increase in net sales was due primarily to an increase in Environmental domestic sales, driven by the higher backlog. Overall, sales of CIS accounted for 52% of overall first half 2023 sales, up from 42% of first half 2022 sales.

Gross Profit

Gross profit for the 2023 first half was $2.9 million compared to $2.4 million in the 2022 first half, an increase of $0.5 million, or 17.2%. The increase in gross profit was due to the combined effect of an increase in net sales along with efficiency gains compared to the first half of 2022, while the company was still navigating the COVID pandemic. Gross profit margin as a percentage of net sales increased to 26.1% for

the 2023 first half compared to 22.9% for the 2022 first half. Cost reduction in an international project was a major factor in the 2023 YTD increase.

Operating Expenses

Operating expenses, including sales and marketing, general and administrative, and research and development, for the 2023 first half were $4.2 million, an increase of $0.6 million, or 15.3%, compared to $3.6 million for the 2022 first half. The increase in operating expenses includes increases in personnel and benefits costs, including at ETC-PZL.

Other Income, Net

Other income, net for the 2023 first half was $2.2 million compared to other income, net of $2.3 million for the 2022 first half, a slight increase of $0.1 million. This is mainly the difference between forgiveness of the PPP loan in 2022 and the facility sale in 2023.

Cash Flows from Operating, Investing, and Financing Activities

During the 2023 first half, due primarily from a decrease in accounts receivable, an increase in customer deposits and the sale of the facility at 125 James Way, the Company provided $9.7 million of cash from operating activities as compared to providing $1.5 million during the 2022 first half. Cash used for investing activities primarily relates to funds used for capital expenditures of equipment and software development. However, as related to ASC 842, the Company’s investing activities used $2.6 million during the 2023 first half compared to $79 thousand during the 2022 first half. $2.5 million was used in support of the new facility lease created by the right of use asset. The Company’s financing activities used $6.0 million of cash during the 2023 first half for repayments under the Company’s credit facilities compared to using $1.3 million of cash during the 2022 first half. This repayment resulted in cash availability of $10.0 million at end of first half of 2023.

Financial Tables Follow

Forward-looking Statements

This news release contains forward-looking statements, which are based on management's expectations and are subject to uncertainties and changes in circumstances. Words and expressions reflecting something other than historical fact are intended to identify forward-looking statements, and these statements may include terminology such as "may", "will", "should", "expect", "plan", "anticipate", "believe", "estimate", "future", "predict", "potential", "intend", or "continue", and similar expressions. We base our forward-looking statements on our current expectations and projections about future events or future financial performance. Our forward-looking statements are subject to known and unknown risks, uncertainties and assumptions about ETC and its subsidiaries that may cause actual results to be materially different from any future results implied by these forward-looking statements. We caution you not to place undue reliance on these forward-looking statements.