ETC Announces Fiscal 2021 Second Quarter Results

SOUTHAMPTON, PA, USA, January 26, 2021 – Environmental Tectonics Corporation (OTC Pink: ETCC) (“ETC” or the “Company”) today reported its financial results for the thirteen week period ended August 28, 2020 (the “2021 second quarter”) and the twenty-six week period ended August 28, 2020 (the “2021 first half”).

Robert L. Laurent, Jr., ETC’s Chief Executive Officer and President stated, “The challenges of fiscal 2020 continued into the 2021 first half as the COVID-19 global pandemic related lock downs continued, further delaying orders and our ability to deliver. We are beginning to see a positive change as we work our way through the second half of fiscal 2021.”

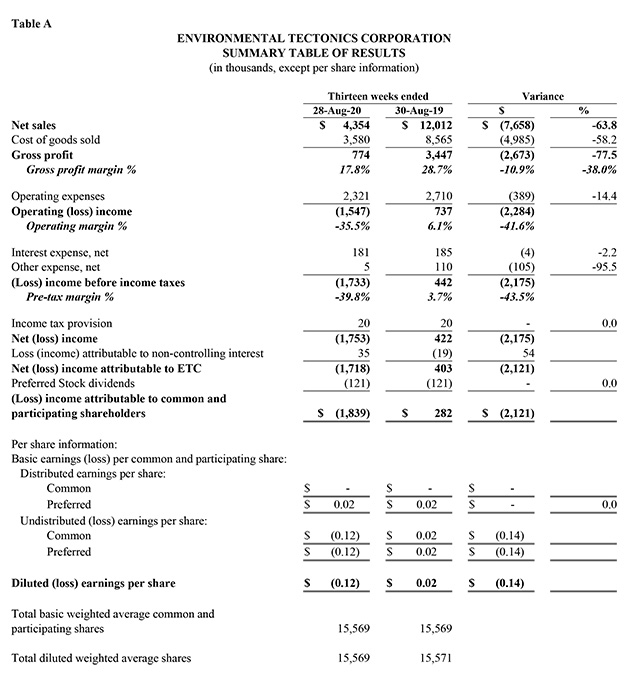

Fiscal 2021 Second Quarter Results of Operations

Net (Loss) Income Attributable to ETC

Net loss attributable to ETC was $1.7 million, or $0.12 diluted loss per share, in the 2021 second quarter, compared to net income attributable to ETC of $0.4 million during the 2020 second quarter, equating to $0.02 diluted earnings per share. The $2.1 million variance is due to the combined effect of a $2.6 million decrease in gross profit, offset, in part, by a $0.4 million decrease in operating expenses and a $0.1 million decrease in other expense, net.

Net Sales

Net sales in the 2021 second quarter were $4.4 million, a decrease of $7.6 million, or 63.8%, compared to 2020 second quarter net sales of $12.0 million. The decrease reflects lower International sales, especially within Aeromedical Training Solutions and ETSS, lower overall Sterilizers sales, and lower monoplace chambers sales as a result of the asset sale on November 27, 2019, offset, in part, by an increase in U.S. Government sales within Aeromedical Training Solutions in conjunction with the U.S. Air Force’s final acceptance of the RAC Contract.

Gross Profit

Gross profit for the 2021 second quarter was $0.8 million compared to $3.4 million in the 2020 second quarter, a decrease of $2.6 million, or 77.5%. The decrease in gross profit was due to lower net sales not being able to support fixed overhead expenses. Lower net sales were generated due to the combination of a lower backlog entering fiscal 2021 compounded with the effects of the COVID-19 global pandemic, which greatly impacted the Company’s ability to generate bookings, especially internationally. Gross profit margin as a percentage of net sales decreased to 17.8% for the 2021 second quarter compared to 28.7% for the 2020 second quarter.

Operating Expenses

Operating expenses, including sales and marketing, general and administrative, and research and development, for the 2021 second quarter were $2.3 million, a decrease of $0.4 million, or 14.4%, compared to $2.7 million for the 2020 second quarter. The decrease in operating expenses was due primarily to lower selling and marketing expenses, which included a decrease in commission expense based on a lower concentration of International sales related to ATS products, a reduction in headcount, and a decrease in travel caused by the COVID-19 global pandemic.

Other Expense, Net

Other expense, net for the 2021 second quarter was $5 thousand compared to $110 thousand for the 2020 second quarter, a decrease of $0.1 million due primarily to lower letter of credit fees and realized exchange gains on foreign currency.

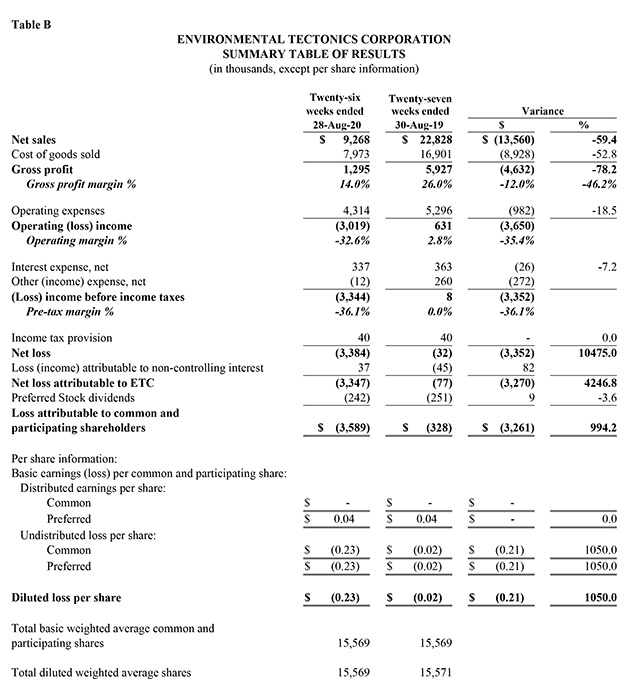

Fiscal 2021 First Half Results of Operations

Net Loss Attributable to ETC

Net loss attributable to ETC was $3.3 million, or $0.23 diluted loss per share, in the 2021 first half, compared to $0.1 million during the 2020 first half, equating to $0.02 diluted loss per share. The $3.2 million variance is due to the combined effect of a $4.6 million decrease in gross profit, offset, in part, by a $1.0 million decrease in operating expenses, a $0.3 million decrease in other expense, net, and a $0.1 million increase in loss attributable to non-controlling interest.

Net Sales

Net sales in the 2021 first half were $9.3 million, a decrease of $13.5 million, or 59.4%, compared to 2020 first half net sales of $22.8 million. The decrease reflects lower International sales, especially within Aeromedical Training Solutions and ETSS, lower Domestic sales, especially within Simulation, lower overall Sterilizers sales, and lower monoplace chambers sales as a result of the asset sale on November 27, 2019, offset, in part, by an increase in U.S. Government sales within Aeromedical Training Solutions in conjunction with the U.S. Air Force’s final acceptance of the RAC Contract.

Gross Profit

Gross profit for the 2021 first half was $1.3 million compared to $5.9 million in the 2020 first half, a decrease of $4.6 million, or 78.2%. The decrease in gross profit was due to lower net sales not being able to support fixed overhead expenses. Lower net sales were generated due to the combination of a lower backlog entering fiscal 2021 compounded with the effects of the COVID-19 global pandemic, which not only impacted the Company’s ability to generate bookings, especially internationally, but also forced the closure of our corporate headquarters and main production plant for about one-third of the 2021 first quarter in accordance with Pennsylvania state mandates. Gross profit margin as a percentage of net sales decreased to 14.0% for the 2021 first half compared to 26.0% for the 2020 first half.

Operating Expenses

Operating expenses, including sales and marketing, general and administrative, and research and development, for the 2021 first half were $4.3 million, a decrease of $1.0 million, or 18.5%, compared to $5.3 million for the 2020 first half. The decrease in operating expenses was due primarily to lower selling and marketing expenses, which included a decrease in commission expense based on a lower concentration of International sales related to ATS products, a reduction in headcount, and a decrease in travel caused by the COVID-19 global pandemic.

Other (Income) Expense, Net

Other income, net for the 2021 first half was $12 thousand compared to other expense, net of $260 thousand for the 2020 first half, a variance of $0.3 million due primarily to lower letter of credit fees and realized exchange gains on foreign currency.

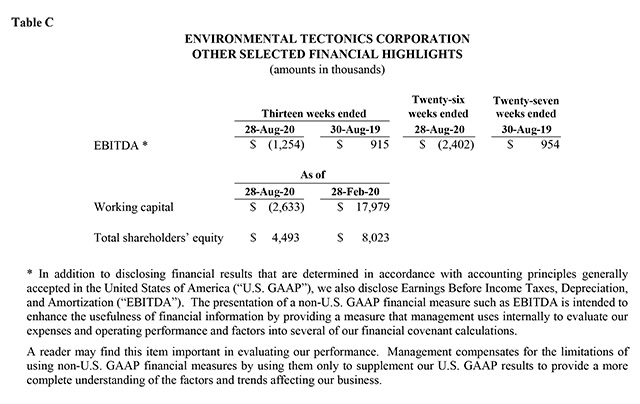

Cash Flows from Operating, Investing, and Financing Activities

During the 2021 first half, due primarily from the net loss incurred, the increase in contract assets, and the decrease in accounts payable, offset, in part by the decrease in accounts receivable, the Company used $4.7 million of cash for operating activities compared to $9.1 million during the 2020 first half. Under Accounting Standards Codification (“ASC”) 606, these accounts represent the timing differences of spending on production activities versus the billing and collecting of customer payments.

Cash used for investing activities primarily relates to funds used for capital expenditures of equipment and software development. The Company’s investing activities used $43 thousand during the 2021 first half compared to $0.2 million during the 2020 first half.

The Company’s financing activities provided $4.0 million of cash during the 2021 first half with proceeds from the Payroll Protection Program loan and borrowings under the Company’s credit facility compared to $6.4 million during the 2020 first half exclusively from borrowings under the Company’s credit facility.

Financial Tables Follow

Forward-looking Statements

This news release contains forward-looking statements, which are based on management's expectations and are subject to uncertainties and changes in circumstances. Words and expressions reflecting something other than historical fact are intended to identify forward-looking statements, and these statements may include terminology such as "may", "will", "should", "expect", "plan", "anticipate", "believe", "estimate", "future", "predict", "potential", "intend", or "continue", and similar expressions. We base our forward-looking statements on our current expectations and projections about future events or future financial performance. Our forward-looking statements are subject to known and unknown risks, uncertainties and assumptions about ETC and its subsidiaries that may cause actual results to be materially different from any future results implied by these forward-looking statements. We caution you not to place undue reliance on these forward-looking statements.