ETC Announces Fiscal 2021 Full Year and Fourth Quarter Results

SOUTHAMPTON, PA, USA, September 1, 2021 – Environmental Tectonics Corporation (OTC Pink: ETCC) (“ETC” or the “Company”) today reported its financial results for the fifty-two week period ended February 26, 2021 (“fiscal 2021”) and the thirteen week period ended February 26, 2021 (the “2021 fourth quarter”).

Robert L. Laurent, Jr., ETC’s Chief Executive Officer and President stated, “Fiscal 2021 was another challenging year as future projects continued to be delayed as ETC entered fiscal 2021 in the early stages of the global COVID-19 pandemic; the effects of which are still ongoing. Now that we have entered fiscal 2022, we are beginning to see these effects diminish as fiscal 2022 first quarter bookings were in excess of $10 million.”

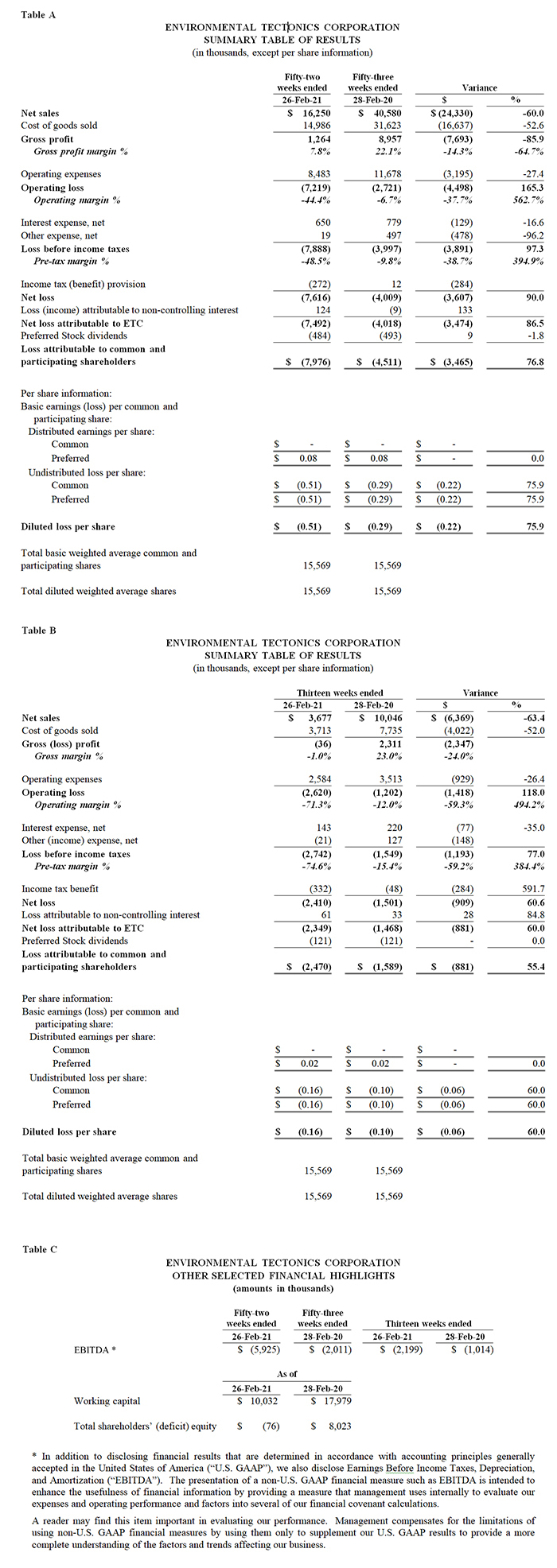

Fiscal 2021 Results of Operations

Bookings / Sales Backlog

Bookings in fiscal 2021 were $15.2 million, leaving our sales backlog as of February 26, 2021, which represents the sales we expect to recognize for our products and services for which control has not yet transferred to the customer, at $16.0 million compared to $17.1 million as of February 28, 2020. We expect to recognize approximately 88% of the total sales backlog as of February 26, 2021 over the next twelve (12) months and approximately 91% over the next twenty-four (24) months as revenue, with the remainder recognized thereafter. Of the February 26, 2021 sales backlog, $10.4 million, or 64.7%, pertains to International contracts within the Aerospace segment.

Net Loss Attributable to ETC

Net loss attributable to ETC was $7.5 million, or $0.51 diluted loss per share, in fiscal 2021, compared to $4.0 million during fiscal 2020, equating to $0.29 diluted loss per share. The $3.5 million variance is due to the combined effect of a $7.7 million decrease in gross profit, offset, in part, by a $3.2 million decrease in operating expenses, a $0.5 million decrease in other expense, a $0.3 million increase in income tax benefit, a $0.1 million decrease in interest expense, and a $0.1 million increase in loss attributable to non-controlling interest.

Net Sales

Net sales for fiscal 2021 were $16.3 million, a decrease of $24.3 million, or 60.0%, compared to fiscal 2020 net sales of $40.6 million. The decrease reflects lower International sales, especially within Aeromedical Training Solutions, lower overall ETSS and Sterilizers sales, and lower monoplace chambers sales as a result of the asset sale on November 27, 2019, offset, in part, by an increase in U.S. Government sales within Aeromedical Training Solutions in conjunction with the United States Air Force’s (“USAF”) final acceptance of the a firm fixed-price contract dated June 14, 2010 to build a suite of research altitude chambers at the Wright-Patterson Air Force Base (the “RAC Contract”). Lower net sales were generated due to the combination of a lower backlog entering fiscal 2021 compounded with the effects of the COVID-19 global pandemic, which not only impacted the Company’s ability to generate bookings, especially internationally, but also forced the closure of the Company’s corporate headquarters and main production plant located in Southampton, Pennsylvania (“ETC-SH”) for about one-third of the 2021 first quarter in accordance with Pennsylvania state mandates.

Gross Profit

Gross profit for fiscal 2021 was $1.3 million compared to $9.0 million in fiscal 2020, a decrease of $7.7 million, or 85.9%. The decrease in gross profit was due to lower net sales not being able to support fixed overhead expenses. Gross profit margin as a percentage of net sales decreased to 7.8% in fiscal 2021 compared to 22.1% in fiscal 2020.

Operating Expenses

Operating expenses, including sales and marketing, general and administrative, and research and development, for fiscal 2021 were $8.5 million, a decrease of $3.2 million, or 27.4%, compared to $11.7 million for fiscal 2020. The decrease in operating expenses was due primarily to a reduction in selling and marketing expenses related to a decrease in commission expense based on a lower concentration of International sales related to ATS products, and a reduction in headcount, and a decrease in travel caused by the COVID-19 global pandemic.

Interest Expense, Net

Interest expense, net, for fiscal 2021 was $0.7 million compared to $0.8 million in fiscal 2020, a decrease of $0.1 million, or 16.6%, due primarily to lower interest rates.

Other Expense, Net

Other expense, net, for fiscal 2021 was $19 thousand compared to $0.5 million in fiscal 2020, a decrease of $0.5 million, or 96.2%, due primarily to lower letter of credit fees and realized exchange gains on foreign currency.

Income Taxes

As of February 26, 2021, the Company reviewed the components of its deferred tax assets and determined, based upon all available information, that it is more likely than not that deferred tax assets relating to its federal and state net operating loss (“NOL”) carryforwards and research and development tax credits will not be realized primarily due to uncertainties related to our ability to utilize them. Accordingly, we have established a $7.8 million valuation allowance for such deferred tax assets that we do not expect to realize. If there is a change in our ability to realize our deferred tax assets for which a valuation allowance has been established, then our tax valuation allowance may decrease in the period in which we determine that realization is more likely than not.

An income tax benefit of $0.3 million was recorded in fiscal 2021 compared to income tax expense of $12 thousand recorded in fiscal 2020. Effective tax rates were 3.5% and -0.3% for fiscal 2021 and fiscal 2020, respectively. The increase in the effective tax rate for fiscal 2021 as compared to fiscal 2021 was driven primarily by the recording of a U.S. federal current tax benefit in fiscal 2021 in conjunction with the receipt of the alternative minimum tax (“AMT”) credit refund.

Fiscal 2021 Fourth Quarter Results of Operations

Net Loss Attributable to ETC

Net loss to ETC was $2.4 million, or $0.16 diluted loss per share, in the 2021 fourth quarter, compared to $1.5 million during the 2020 fourth quarter, equating to $0.10 diluted loss per share. The $0.9 million variance is due to the combined effect of a $2.3 million decrease in gross profit, offset, in part, by a $0.9 million decrease in operating expenses, a $0.3 million increase in income tax benefit, a $0.1 million decrease in other expense, and a $0.1 million decrease in interest expense.

Net Sales

Net sales for the 2021 fourth quarter were $3.7 million, a decrease of $6.3 million, or 63.4%, compared to net sales of $10.0 million for the 2020 fourth quarter. The decrease reflects lower International sales within Aeromedical Training Solutions, lower Domestic sales within Service and Spares, and lower overall sales of ETSS. Lower net sales were generated due to the combination of a lower backlog entering fiscal 2021 compounded with the effects of the COVID-19 global pandemic, which impacted the Company’s ability to generate bookings, especially internationally.

Gross (Loss) Profit

ETC incurred a gross loss of $36 thousand in the 2021 fourth quarter, a decrease of $2.3 million compared to the gross profit for the 2020 fourth quarter due to lower net sales not being able to support fixed overhead expenses. Gross margin as a percentage of net sales decreased to -1.0% in the 2021 fourth quarter compared to 23.0% in the 2020 fourth quarter.

Operating Expenses

Operating expenses, including sales and marketing, general and administrative, and research and development, for the 2021 fourth quarter were $2.6 million, a decrease of $0.9 million, or 26.4%, compared to $3.5 million for the 2020 fourth quarter. The decrease in operating expenses was due primarily to a reduction in selling and marketing expenses related to a decrease in commission expense based on a lower concentration of International sales related to ATS products, and a reduction in headcount, and a decrease in travel caused by the COVID-19 global pandemic.

Interest Expense, Net

Interest expense, net, for the 2021 fourth quarter was $0.1 million compared to $0.2 million in the 2020 fourth quarter, a decrease of $0.1 million, or 35.0%, due primarily to lower interest rates.

Other (Income) Expense, Net

Other income, net, for the 2021 fourth quarter was $21 thousand compared to other expense, net of $127 thousand in the 2020 fourth quarter, a variance of $148 thousand, due primarily to lower letter of credit fees and realized exchange gains on foreign currency.

Income Taxes

An income tax benefit of $0.3 million was recorded in the 2021 fourth quarter compared to $48 thousand in the 2020 fourth quarter. Effective tax rates were 12.1% and 3.1% for the 2021 fourth quarter and the 2020 fourth quarter, respectively. The increase in the effective tax rate for fiscal 2021 as compared to fiscal 2021 was driven primarily by the recording of a U.S. federal current tax benefit in fiscal 2021 in conjunction with the receipt of the AMT credit refund.

Liquidity and Capital Resources

As of February 26, 2021, the Company’s availability under the Revolving Line of Credit was $5.3 million. This reflected cash borrowings of $17.0 million and net outstanding standby letters of credit of approximately $2.7 million. As of August 2, 2021, the date of our most current Revolving Line of Credit statement, the Company’s availability under the Revolving Line of Credit was also approximately $2.7 million. The Company had working capital of $10.0 million as of February 26, 2021 compared to working capital of $18.0 million as of February 28, 2020. The decrease in working capital was primarily the result of a decrease in contract assets. With unused availability under the Company’s various current lines of credit, the further conversion of contract assets into cash, the collection of milestone payments associated with several International contracts, and expected deposits on fiscal 2022 bookings, the Company anticipates its sources of liquidity will be sufficient to fund its operating activities, anticipated capital expenditures, and debt repayment obligations throughout fiscal 2022.

Cash flows from operating activities

During fiscal 2021, due primarily from the conversion of contract assets into cash, the Company broke even with respect to cash flows from operating activities compared to using $9.3 million in fiscal 2020.

Cash flows from investing activities

Cash used for investing activities primarily relates to funds used for capital expenditures in property, plant, and equipment and software development. The Company’s fiscal 2021 and fiscal 2020 investing activities used $0.1 million and $0.3 million, respectively, which consisted primarily of equipment and software enhancements for our ATFS and ADMS technologies, and costs to upgrade existing information technology systems and enhance our manufacturing and ETSS testing capabilities.

Cash flows from financing activities

During fiscal 2021, the Company’s financing activities used $0.6 million of cash for repayments under the Company’s credit facility, offset, in part, by proceeds from the Paycheck Protection Program loan. During fiscal 2020, the Company’s financing activities provided $7.7 million of cash from borrowings under the Company’s credit facility.

Financial Tables Follow

Forward-looking Statements

This news release contains forward-looking statements, which are based on management's expectations and are subject to uncertainties and changes in circumstances. Words and expressions reflecting something other than historical fact are intended to identify forward-looking statements, and these statements may include terminology such as "may", "will", "should", "expect", "plan", "anticipate", "believe", "estimate", "future", "predict", "potential", "intend", or "continue", and similar expressions. We base our forward-looking statements on our current expectations and projections about future events or future financial performance. Our forward-looking statements are subject to known and unknown risks, uncertainties and assumptions about ETC and its subsidiaries that may cause actual results to be materially different from any future results implied by these forward-looking statements. We caution you not to place undue reliance on these forward-looking statements.