ETC Announces Fiscal 2013 Full Year and Fourth Quarter Results

Fiscal 2013 Highlights:

- Gross profit margin as a percentage of net sales of 39.6%

- Pre-tax income increased 17.8% to a record $8.8 million

- Diluted earnings per share increased 46.2% to $0.19

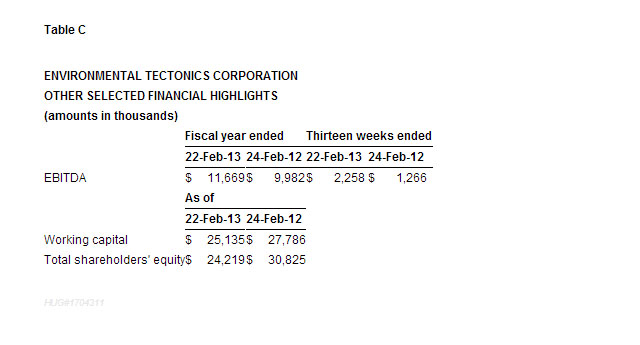

- EBITDA increased 16.9% to a record $11.7 million

- Completed a financial restructuring that reduces annual net cash payments for dividends and interest by approximately $1.5 million, and reduced Common Stock equivalents by 5 million shares

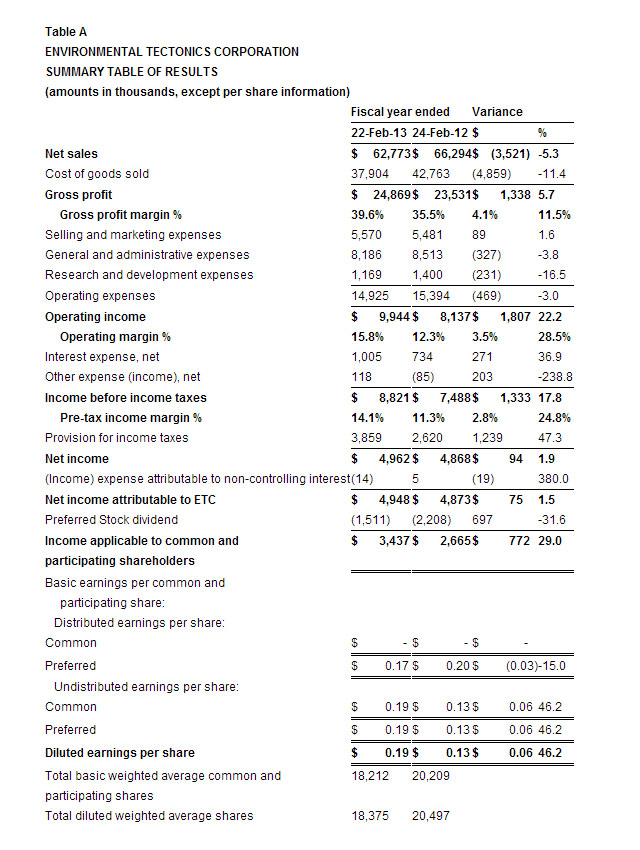

SOUTHAMPTON, PA, USA, May 23, 2013 – Environmental Tectonics Corporation (OTC Pink: ETCC) (“ETC” or the “Company”) today reported an increase in net income attributable to ETC for fiscal 2013 to $5.0 million, or $0.19 per diluted share, compared to net income attributable to ETC of $4.9 million, or $0.13 per diluted share, in fiscal 2012. This improvement was achieved on lower net sales of $62.8 million for fiscal 2013, compared to $66.3 million in fiscal 2012. The 5.3% reduction in net sales reflects decreased sales to the U.S. Government and to International customers, offset in part by increased sales to Domestic customers.

Income before income taxes for fiscal 2013 increased to $8.8 million, a $1.3 million, or 17.8%, increase compared to $7.5 million in fiscal 2012. The increase in income before income taxes was due primarily to an increase in gross profit margin as a percentage of net sales to 39.6% for fiscal 2013 compared to 35.5% in fiscal 2012, which was the result of a more profitable product and customer sales mix, combined with a 3.0% decrease in operating expenses.

William F. Mitchell, ETC’s President and Chief Executive Officer, stated, “We are very pleased that ETC achieved increased profitability and earnings per share on lower net sales in fiscal 2013, which reflects both solid operating income and the positive affect of our financial restructuring.”

Business Overview:

ETC is a significant supplier and innovator in the following product areas: (i) software driven products and services used to create and monitor the physiological effects of flight, including high performance jet tactical flight simulation, upset recovery and spatial disorientation, and both suborbital and orbital commercial human spaceflight; collectively, Aircrew Training Systems (“ATS”); (ii) altitude (hypobaric) chambers; (iii) the Advanced Disaster Management Simulator (“ADMS”); (iv) steam and gas (ethylene oxide) sterilizers; (v) environmental testing and simulation devices; and (vi) hyperbaric (100% oxygen) chambers for one person (monoplace chambers).

We operate in two primary business segments, Aerospace Solutions (“Aerospace”) and Commercial/Industrial Systems (“CIS”). Aerospace encompasses the design, manufacture, and sale of: (i) Aircrew Training Systems; (ii) altitude (hypobaric) chambers; (iii) hyperbaric chambers for multiple persons (multiplace chambers); and (iv) ADMS, as well as integrated logistics support for customers who purchase these products or similar products manufactured by other parties. These products and services provide customers with an offering of comprehensive solutions for improved readiness and reduced operational costs. Sales of our Aerospace products are made principally to U.S. and foreign government agencies. CIS encompasses the design, manufacture, and sale of: (i) steam and gas (ethylene oxide) sterilizers; (ii) environmental testing and simulation devices; and (iii) hyperbaric (100% oxygen) chambers for one person (monoplace chambers), as well as parts and service support for customers who purchase these products or similar products manufactured by other parties. Sales of our CIS products are made principally to the healthcare, pharmaceutical, and automotive industries.

We presently have two foreign operating subsidiaries. ETC-PZL Aerospace Industries SP. Z 0.0, (“ETC-PZL”), our 95%-owned subsidiary in Warsaw, Poland, manufactures simulators for our Aerospace segment and provides software to support our domestic products. Environmental Tectonics Corporation (Europe) Limited (“ETC-Europe”), our 99%-owned subsidiary, functions as a sales office in the United Kingdom.

ETC’s unique ability to offer complete systems, designed and produced to high technical standards, sets it apart from its competition. ETC is headquartered in Southampton, PA. For more information about ETC, visit www.etcusa.com.

Fiscal 2013 Results of Operations:

Domestic sales in fiscal 2013 were $19.0 million, an increase of $2.4 million, or 14.5%, over fiscal 2012, and represented 30.3% of total net sales, compared to 25.1% in fiscal 2012. The increase in Domestic sales is primarily a result of a $3.0 million, or 42.8%, increase in sales of Sterilization Systems, which reflects record orders received in fiscal 2012, and a $1.3 million, or 74.4%, increase in sales of Environmental Testing and Simulation Systems. These increases were partially offset by a $0.9 million, or 41.9%, decrease in sales of ADMS, as well as smaller decreases in other categories.

U.S. Government sales in fiscal 2013 were $22.2 million, a decrease of $5.0 million, or 18.3%, from fiscal 2012, which reflect lower sales related to a high performance human centrifuge, offset in part, by increased sales related to a suite of altitude (hypobaric) chambers. U.S. Government sales represented 35.4% of total net sales in fiscal 2013 compared with 41.0% in fiscal 2012. Given the existing progress made on U.S. Government contracts in the Company’s sales backlog, the Company anticipates the concentration of sales with the U.S. Government will continue to lessen in fiscal 2014.

International sales in fiscal 2013, including those of the Company’s foreign subsidiaries, were $21.5 million, a decrease of $1.0 million, or 4.3%, from fiscal 2012, due primarily to a $1.6 million, or 11.8%, decrease in sales of ATS related products, and a $1.1 million, or 40.1%, decrease in Hyperbaric sales. These decreases were offset, in part, by a $1.0 million, or 44.7%, increase in ETC-PZL sales, as well as smaller increases in other product categories. In aggregate, International sales represented 34.3% of the Company’s total net sales, an increase over 33.9% in fiscal 2012. In both fiscal 2013 and fiscal 2012, International sales totaling at least $500,000 were made to customers in eight (8) different countries. Fluctuations in sales to international countries from year to year primarily reflect percentage of completion revenue recognition on the level and stage of development and production on multi-year long-term contracts.

Segment sales

Aerospace sales were $42.3 million in fiscal 2013, a decrease of $6.6 million, or 13.5%, from sales of $48.9 million in fiscal 2012. This decrease was primarily due to less revenue recorded on one of our international contracts for multiple Aerospace products as the aeromedical center in which this equipment is housed was dedicated in October 2012. Sales of these products accounted for 67.4% of our total net sales for fiscal 2013 versus 73.8% in fiscal 2012. Sales within our CIS segment increased $3.1 million, or 17.7%, and constituted 32.6% of our total net sales for fiscal 2013 compared to 26.2% in fiscal 2012.

Given the Company’s sales backlog as of February 22, 2013, it is anticipated that our Aerospace segment will begin to generate more of its revenues from International contracts, while sales within our CIS segment are expected to be affected by a lower sales backlog entering fiscal 2014.

Gross profit

Gross profit for fiscal 2013 increased by $1.3 million, or 5.7%, over fiscal 2012. This improvement was achieved despite lower sales due primarily to a more profitable product and customer sales mix. Gross profit margin as a percentage of net sales increased to 39.6% in fiscal 2013 over 35.5% in fiscal 2012. This increase was due primarily to fiscal 2012 costs related to a U.S. government contract, and to a more profitable product and customer sales mix in fiscal 2013.

Operating Expenses

Selling and marketing expenses for fiscal 2013 of $5.6 million increased slightly over fiscal 2012. As a percentage of net sales, selling and marketing expenses increased to 8.9% in fiscal 2013 from 8.3% in fiscal 2012 due primarily to lower net sales in fiscal 2013.

General and administrative expenses for fiscal 2013 of $8.2 million decreased slightly by $0.3 million, or 3.8%, from fiscal 2012. The decrease is primarily the result of lower professional fees and an on-going effort to reduce non-revenue generating expenses. As a percentage of net sales, general and administrative expenses increased to 13.0% in fiscal 2013 compared to 12.8% in fiscal 2012 due primarily to lower net sales in fiscal 2013.

Research and development expenses include spending for potential new products and technologies, and work performed internationally under government grant programs. This spending, net of grant payments from the Polish and Turkish governments, totaled $1.2 million for fiscal 2013 compared to $1.4 million in fiscal 2012, a decrease of $0.2 million, or 16.5%. The decrease was a result of more research and development employees being assigned to specific contracts; thus, expenses related to these employees were included in cost of sales in fiscal 2013. Most of the Company’s research efforts, which were and continue to be a significant cost of its business, are included in cost of sales for applied research for specific contracts, as well as research for feasibility and technology updates. As a percentage of net sales, research and development expenses decreased slightly to 1.9% in fiscal 2013 compared to 2.1% in fiscal 2012.

Operating income

Operating income increased $1.8 million, or 22.2%, to $9.9 million for fiscal 2013 compared to $8.1 million in fiscal 2012. The 5.7% increase in gross profit combined with a 3.0% reduction in operating expenses generated the increase in operating income.

On a segment basis, Aerospace had operating income of $9.1 million for fiscal 2013, a $1.9 million, or 26.7%, increase in operating income compared to $7.2 million in fiscal 2012. CIS had operating income of $3.9 million for fiscal 2013, a $0.2 million, or 4.2%, decrease in operating income compared to $4.1 million in fiscal 2012. These segment operating results were offset, in part, by unallocated corporate expenses.

Given the positive operating performance in fiscal 2013, the level and mix of the Company’s sales backlog as of February 22, 2013, open proposals and proposals under preparation, which include quotations for some significant potential international contract awards, and the Company’s continuing positive feedback from potential customers for its ATFS technology, it is anticipated that the Company will produce income from operations in fiscal 2014.

Net income attributable to ETC

Net income attributable to ETC was $5.0 million, or $0.19 per diluted share, in fiscal 2013 versus $4.9 million, or $0.13 per diluted share, in fiscal 2012; an increase of $0.1 million, or 1.5%. Operating income for fiscal 2013 was $9.9 million versus $8.1 million in fiscal 2012, an increase of $1.8 million, or 22.2%. Operating income was favorably affected in dollars by a higher gross profit and was favorably affected as a percentage of net sales by a 3.0% decrease in operating expenses. The significant increase in diluted earnings per share was due in part to increased income and also to reduced shares outstanding following the repurchase of 386 shares of Series D Preferred Stock, representing all of the Company’s issued and outstanding shares of Series D Preferred Stock, and 9,614 shares of Series E Preferred Stock, representing a significant portion of the Company’s issued and outstanding Series E Preferred Stock.

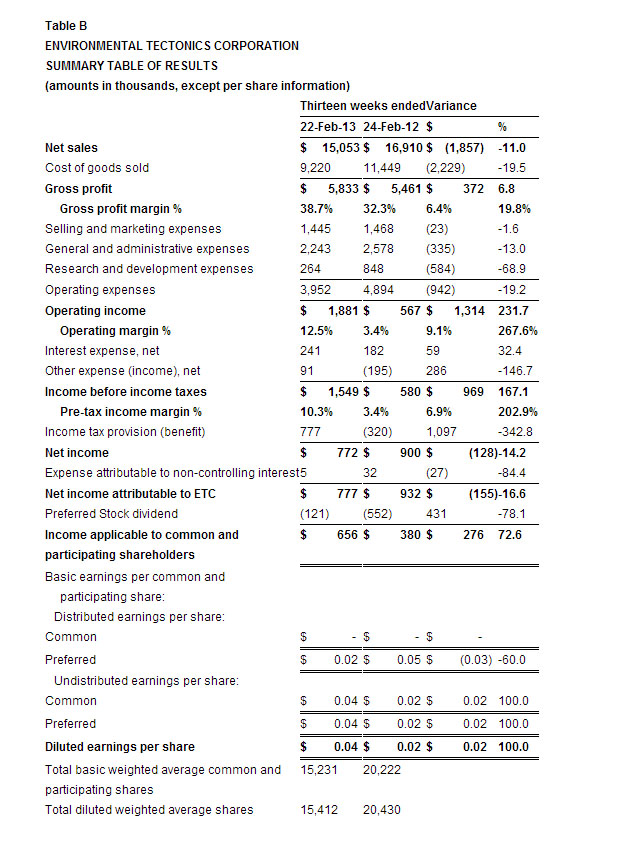

Fiscal 2013 Fourth Quarter Results of Operations:

Net sales for the fiscal 2013 fourth quarter (“the 2013 quarter”) of $15.1 million, decreased $1.8 million, or 11.0% compared to net sales of $16.9 million in the fiscal 2012 fourth quarter (“the 2012 quarter”). The decrease reflects decreased sales to Domestic customers and to the U.S. Government, while sales to International customers remained relatively flat.

Despite lower net sales, income before income taxes for the 2013 quarter was $1.6 million, a $1.0 million, or 167.1%, increase over the 2012 quarter. The increase in income before income taxes was due primarily to an increase in gross profit margin as a percentage of net sales to 38.7% for the 2013 quarter compared to 32.3% in the 2012 quarter, which was the result of a more profitable product and customer sales mix, combined with a 19.2% decrease in operating expenses.

Domestic sales for the 2013 quarter were $4.3 million, a decrease of $1.3 million, or 23.4%, compared to $5.6 million in the 2012 quarter, and represented 28.4% of total net sales in the 2013 quarter compared to 33.0% in the 2012 quarter. The decrease in Domestic sales is primarily a result of lower sales of Hyperbaric (monoplace) chambers, Environmental Testing and Simulation Systems, and spare parts. These decreases were offset, in part, by an increase in sales of Sterilization Systems, which reflects record orders received in fiscal 2012.

U.S. Government sales for the 2013 quarter were $3.7 million, a decrease of $0.5 million, or 12.9%, compared to $4.2 million in the 2012 quarter, which reflect lower sales related to a high performance human centrifuge, offset, in part, by increased sales related to a suite of altitude (hypobaric) chambers. U.S. Government sales represented 24.6% of total net sales in the 2013 quarter compared to 25.1% in the 2012 quarter. Given the existing progress made on U.S. Government contracts in the Company’s sales backlog as of February 22, 2013, the Company anticipates the concentration of sales with the U.S. Government will continue to lessen in fiscal 2014.

International sales in both the 2013 quarter and the 2012 quarter, including those of the Company’s foreign subsidiaries, were $7.1 million. Although International sales remained flat quarter over quarter, there was a shift in sales away from ATS, primarily due to less revenue recorded on one of our international contracts for multiple Aerospace products as the aeromedical center in which this equipment is housed was dedicated in October 2012, and towards ETC-PZL and Sterilization Systems.

Segment sales

Aerospace sales were $10.1 million for the 2013 quarter, a decrease of $1.4 million, or 11.9%, compared to sales of $11.5 million in the 2012 quarter. Sales of these products accounted for 67.2% of total net sales in the 2013 quarter compared to 67.9% in the 2012 quarter. CIS sales decreased $0.5 million, or 9.0%, to $4.9 million for the 2013 quarter compared to $5.4 million in the 2012 quarter, and constituted 32.8% of total net sales in the 2013 quarter compared to 32.1% in the 2012 quarter.

Gross profit

Gross profit for the 2013 quarter was $5.8 million compared to $5.4 million in the 2012 quarter, an increase of $0.4 million, or 6.8%. The increase in gross profit was achieved despite a decrease in net sales, due primarily to the increase in gross profit margin as a percentage of net sales to 38.7% for the 2013 quarter from 32.3% in the 2012 quarter. This increase was due primarily to costs incurred in the 2012 quarter related to a U.S. government contract, and to a more profitable product and customer sales mix for the 2013 quarter.

Operating expenses

Selling and marketing expenses for the 2013 quarter of $1.5 million remained unchanged compared to the 2012 quarter. As a percentage of net sales, selling and marketing expenses increased to 9.6% in the 2013 quarter from 8.7% in the 2012 quarter. The increase is primarily the result of a decrease in net sales.

General and administrative expenses for the 2013 quarter were $2.2 million compared to $2.5 million in the 2012 quarter, a decrease of $0.3 million, or 13.0%. As a percentage of net sales, general and administrative expenses decreased to 14.9% in the 2013 quarter from 15.2% in the 2012 quarter. The decrease is primarily the result of lower professional fees and an on-going effort to reduce non-revenue generating expenses.

Research and development expenses include spending for potential new products and technologies, and internationally, work performed under government grant programs. This spending, net of grant payments from the Polish and Turkish governments, totaled $0.3 million for the 2013 quarter compared to $0.9 million for the 2012 quarter, a decrease of $0.6 million, or 68.9%. The decrease was a result of more research and development employees being assigned to specific contracts; thus, expenses related to these employees were included in cost of sales in the 2013 quarter. Most of the Company’s research efforts, which were and continue to be a significant cost of its business, are included in cost of sales for applied research for specific contracts, as well as research for feasibility and technology updates. As a percentage of net sales, research and development expenses decreased to 1.8% in the 2013 quarter compared to 5.0% in the 2012 quarter.

Operating income

Operating income increased by $1.3 million, or 231.7%, to $1.9 million for the 2013 quarter compared to $0.6 million in the 2012 quarter. Operating income as a percentage of net sales increased to 12.5% for the 2013 quarter from 3.4% in the 2012 quarter. The 6.8% increase in gross profit combined with a 19.2% reduction in operating expenses generated the increase in operating income.

On a segment basis, Aerospace had operating income of $2.2 million for the 2013 quarter, a $1.8 million increase from operating income of $0.4 million in the 2012 quarter. CIS had operating income of $0.5 million in the 2013 quarter, a $0.6 million decrease from operating income of $1.1 million in the 2012 quarter. These segment operating results were offset, in part, by unallocated corporate expenses of $0.8 million and $1.0 million in the 2013 quarter and the 2012 quarter, respectively.

Net income attributable to ETC

Net income attributable to ETC was affected by an income tax provision of $0.8 million for the 2013 quarter compared to an income tax benefit of $0.3 million in the 2012 quarter. As a result, net income attributable to ETC was $0.8 million for the 2013 quarter, or $0.04 per diluted share, versus $0.9 million, or $0.02 per diluted share, in the 2012 quarter. The significant increase in diluted earnings per share was due in part to increased operating income, offset by a higher tax provision, and also the positive affect of reduced shares outstanding following the repurchase of 386 shares of Series D Preferred Stock, representing all of the Company’s issued and outstanding shares of Series D Preferred Stock, and 9,614 shares of Series E Preferred Stock, representing a significant portion of the Company’s issued and outstanding Series E Preferred Stock.

Financial Tables Follow

Forward-looking Statements

This news release contains forward-looking statements, which are based on management's expectations and are subject to uncertainties and changes in circumstances. Words and expressions reflecting something other than historical fact are intended to identify forward-looking statements, and these statements may include terminology such as "may", "will", "should", "expect", "plan", "anticipate", "believe", "estimate", "future", "predict", "potential", "intend", or "continue", and similar expressions. We base our forward-looking statements on our current expectations and projections about future events or future financial performance. Our forward-looking statements are subject to known and unknown risks, uncertainties and assumptions about ETC and its subsidiaries that may cause actual results to be materially different from any future results implied by these forward-looking statements. We caution you not to place undue reliance on these forward-looking statements.