Environmental Tectonics Corporation Announces Second Quarter and Year-to-Date Fiscal 2011 Results

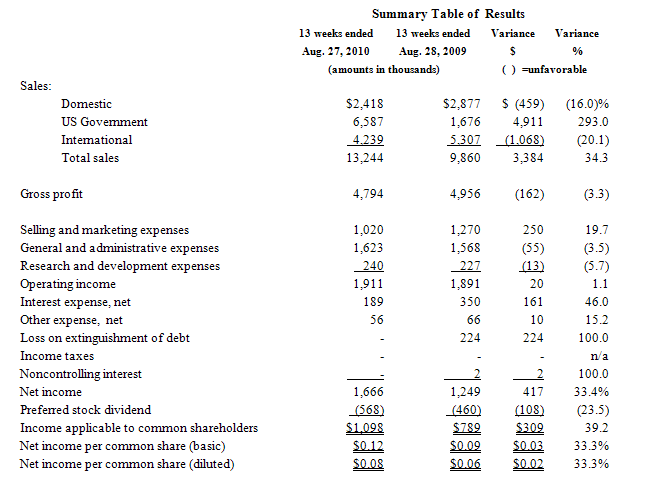

Southampton, PA, September 24, 2010 — Environmental Tectonics Corporation (OTC Bulletin Board: ETCC) (“ETC”, “we”, or the “Company”) today announced that sales for the second quarter of fiscal 2011, which ended August 27, 2010 were $13,244,000 as compared to $9,860,000 for the second quarter of fiscal 2010, an increase of $3,384,000 or 34.3%. Sales for the first half of fiscal 2011 were $25,365,000 as compared to $19,441,000 for the first half of fiscal 2010, an increase of $5,924,000 or 30.5%.

For the second quarter of fiscal 2011, the Company had a net income of $1,666,000 or $0.12 per share (basic) and $0.08 (diluted) compared to net income of $1,249,000 or $0.09 per share (basic) and $0.06 (diluted), for the second quarter of fiscal 2010, representing an increase of $417,000 or 33.4%. The increase reflected a reduction in selling and marketing expenses, interest expense and a loss on extinguishment of debt of $224,000, which the Company recognized in the prior year.

For fiscal year to date, the Company had a net income of $3,602,000 or $0.27 per share (basic) and $0.17 (diluted) during the first half of fiscal 2011 compared to net income of $2,019,000 or $0.15 per share (basic) and $0.09 (diluted), for the second quarter of fiscal 2010, representing an improvement of $1,583,000 or 78.4%. The improvement reflected an increase in gross profit (reflecting the higher sales level) coupled with lower operating expenses and interest expense. Increased research and development expenses acted as a partial offset. Due to the utilization of net operating loss carry forwards, no provision for income taxes was recorded in the first half of fiscal 2011 or 2010.

Our sales backlog at August 27, 2010 and February 26, 2010, for work to be performed and revenue to be recognized under written agreements after such dates, was $122,111,000 and $96,964,000, respectively. The geographic composition of the August 27, 2010 consists of U.S. Government (63.6%), International (31.7%) and Domestic (4.7%). William F. Mitchell, ETC’s President and Chairman, stated, “This financial report reflects the significant impact of numerous major contracts which were booked in the last 12 months. Awards have been received from the U.S. Navy and Air Force for state-of-the-art simulators and from a long time customer in Southeast Asia for multiple aircrew training simulators.

“The impact of our positive cash flow from operations and availability under our lines cannot be underestimated. Multi-year long-term contracts require significant cash outlays during certain phases of execution. A growing company requires cash to expand its operation. I am very encouraged that ETC is finally benefiting from our many years of product development and engineering innovation.”

Financial Results

Thirteen weeks ended November 27, 2009 compared to thirteen weeks ended November 28, 2008

Sales for the first half of fiscal 2011 were $25,365,000 as compared to $19,441,000 for the first half of fiscal 2010, an increase of $5,924,000 or 30.5%. Significant increases were realized in the U.S. Government and Domestic markets offset in part in by a decline in International sales.

Domestic sales in the first half of fiscal 2011 were $5,336,000 as compared to $4,836,000 in the first half of fiscal 2010, an increase of $500,000 or 10.3%, reflecting a significant increase in the sterilizer product line (up $1,058,000 or 59.3%) partially offset by declines in most other product areas. Domestic sales represented 21.0% of the Company’s total sales in the first half of fiscal 2011, as compared to 24.9% for the first half of fiscal 2010.

U.S. Government sales in the first half of fiscal 2011 were $10,573,000 as compared to $3,512,000 in the first half of fiscal 2010, an increase of $7,061,000 or 201.1%, and represented 41.7% of total sales in the first half of fiscal 2011 versus 18.1% for the first half of fiscal 2010. This increase is the result of sales of the Company’s Pilot Training Systems products under significant contracts from the U.S. Navy for a research disorientation trainer and the U.S. Air Force to provide high performance training and research human centrifuge and a suite of altitude chambers.

International sales, which include sales in the Company’s subsidiary in Poland, for the first half of fiscal 2011 were $9,456,000 as compared to $11,093,000 in the first half of fiscal 2010, a decrease of $1,637,000 or 14.8%, and represented 37.3% of total sales, as compared to 57.0% in the first half of fiscal 2010. International performance reflected lower simulation sales (down $2,492,000 or 90.5%) primarily for a contract in the Middle East which was completed in fiscal 2010.

Gross profit for the first half of fiscal 2011 was $9,924,000 as compared to $9,383,000 in the first half of fiscal 2010, an increase of $541,000 or 5.8%. As a percentage of sales, gross profit for the first half of fiscal 2011 was 39.1% compared to 48.3% for the same period a year ago. The gross margin dollar increase followed the sales increase in both governmental and domestic sales which was primarily offset by a reduction in higher margin international sales. The 9.2 percentage point reduction in the gross margin rate as a percentage of sales primarily reflected reductions in the ATS and simulation product areas.

Selling and marketing expenses for the first half of fiscal 2011 were $2,122,000 as compared to $2,524,000 in the first half of fiscal 2010, a decrease of $402,000 or 15.9%. This decrease primarily reflected reduced bid and proposal expenses and reduced commissions on the mix shift in sales in the first half of fiscal 2011 to U.S. Government sales. General and administrative expenses for the first half of fiscal 2011 were $3,086,000 as compared to $3,170,000 in the first half of fiscal 2010, a decrease of $84,000 or 2.6%. Research and development expenses, which are charged to operations as incurred, were $564,000 for the first half of fiscal 2011 as compared to $455,000 for the first half of fiscal 2010.

In the first half of fiscal 2010, the Company recorded a loss on extinguishment of debt related to an exchange transaction which was effected on July 2, 2009. Interest expense for the first half of fiscal 2011 was $417,000 as compared to $866,000 for the first half of fiscal 2010, representing a decrease of $449,000 or 51.9%, reflecting reduced bank borrowing and the July 2009 exchange of a $10 million convertible note for preferred stock. Other expense, net, was $128,000 for the first half of fiscal 2011 versus $121,000 for the first half of fiscal 2010. These expenses consist primarily of bank and letter of credit fees as well as foreign currency exchange gains or losses.

Due to the utilization of net operating loss carry forwards available the Company did not record an income tax expense on the income in the first half of fiscal 2011 or 2010.

The reader is referred to the Company’s Annual Report on Form 10-K for the period ended February 26, 2010, filed on May 27, 2010, for additional information on the Company.

Forward-looking Statements

This news release contains forward-looking statements, which are based on management's expectations and are subject to uncertainties and changes in circumstances. Words and expressions reflecting something other than historical fact are intended to identify forward-looking statements, and these statements may include terminology such as "may", "will", "should", "expect", "plan", "anticipate", "believe", "estimate", "future", "predict", "potential", "intend", or "continue", and similar expressions. We base our forward-looking statements on our current expectations and projections about future events or future financial performance. Our forward-looking statements are subject to known and unknown risks, uncertainties and assumptions about ETC and its subsidiaries that may cause actual results to be materially different from any future results implied by these forward-looking statements. We caution you not to place undue reliance on these forward-looking statements.