ETC Announces Fiscal 2025 Third Quarter Results

SOUTHAMPTON, PA, USA, January 10, 2025 – Environmental Tectonics Corporation (OTC Pink: ETCC) (“ETC” or the “Company”) today reported its financial results for the thirteen week period ended November 22, 2024 (the “2025 third quarter”) and the fiscal first three quarters ended November 22, 2024.

Robert L. Laurent, Jr., ETC’s Chief Executive Officer and President stated, “We are extremely pleased with the overall 59% increase in third quarter sales versus the prior year, as well as our net income of $2.4 million compared to net income of $0.5 million the prior year, an increase of 390%. At the same time, bookings remain strong in the third quarter, which has contributed to the current $102.6 million backlog. This continued acceleration in sales and strong backlog position us well moving forward.”

Fiscal 2025 Third Quarter Results of Operations

Net Income

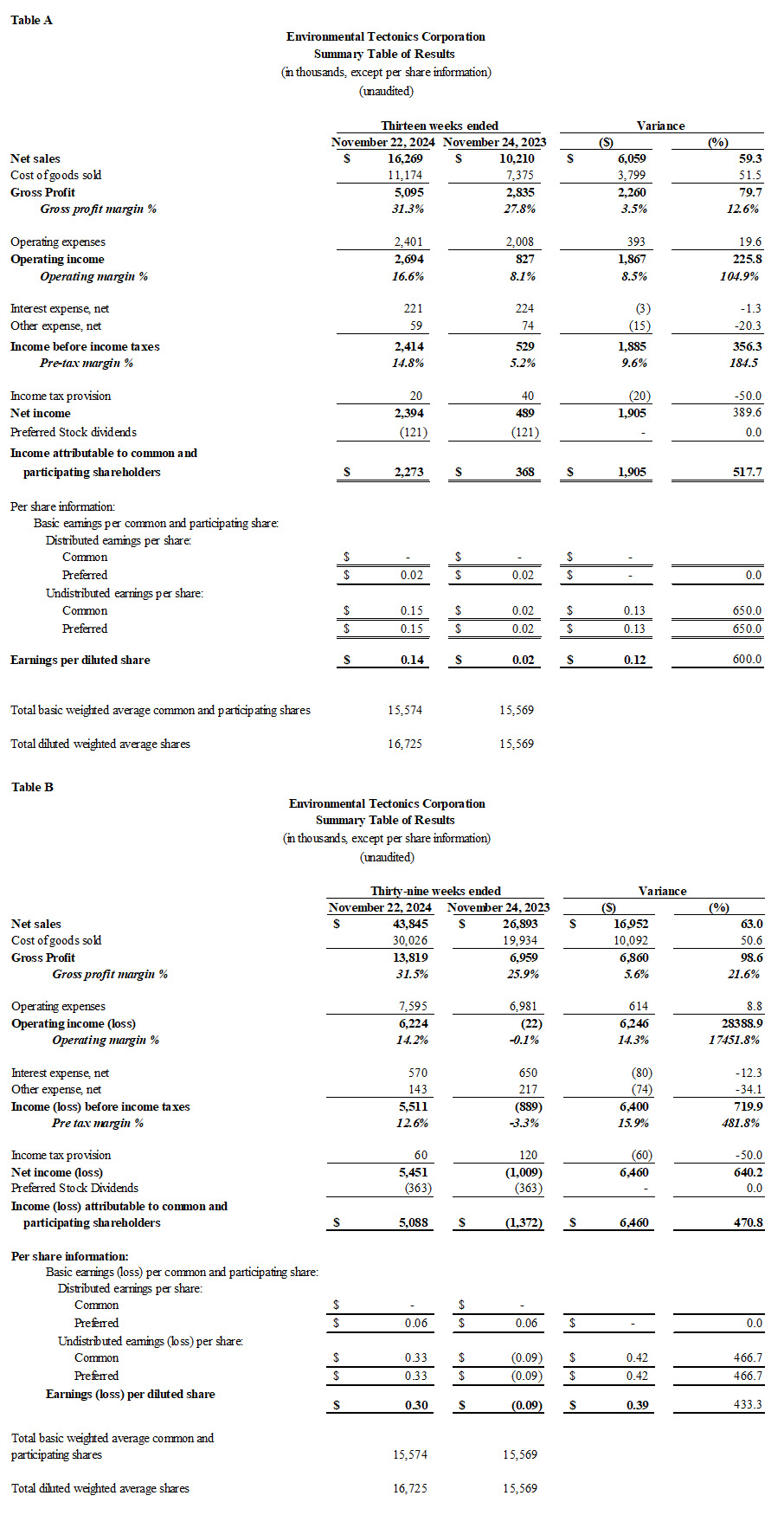

Net income was $2.4 million, or $0.14 earnings per diluted share, in the 2025 fiscal third quarter, compared to net income of $0.5 million during the 2024 fiscal third quarter, equating to $0.02 earnings per diluted share. The $1.9 million favorable variance is primarily attributable to a $6.1 million increase in net sales as well as a 3.5% increase in gross profit margin percentage

Net Sales

Net sales in the 2025 fiscal third quarter were $16.3 million, an increase of $6.1 million, or 59.3%, compared to 2024 fiscal third quarter net sales of $10.2 million. The increase in net sales was driven by a $1.8 million, or 34.3%, increase in aeromedical training solutions, a $2.8 million, or 77.8% increase in sterilizer systems, $1.0 million, or 432.6% increase in environmental testing and simulation systems, and a $0.6 million, or 274.2% increase in service and spare parts net sales in the 2025 fiscal third quarter as compared to 2024 fiscal third quarter net sales. Bookings in the 2025 fiscal third quarter were $9.3 million as compared to $13.2 million in the 2024 fiscal third quarter. Bookings in the 2025 fiscal third quarter were driven by $7.3 million of Aerospace Solutions orders and $2.0 million of Commercial/Industrial Systems orders.

Gross Profit

Gross profit for the 2025 fiscal third quarter of $5.1 million increased from $2.8 million in the 2024 fiscal third quarter, an increase of $2.3 million, or 79.7%. The increase in gross profit was due to the increase in sales and an improvement in the gross profit margin percentage by 3.5% from 27.8% in the 2024 fiscal third quarter to 31.3% in the 2025 fiscal third quarter.

Operating Expenses

Operating expenses, including sales and marketing, general and administrative, and research and development, for the 2025 fiscal third quarter were $2.4 million, an increase of $0.4 million, or 19.6%, compared to $2.0 million for the 2024 fiscal third quarter. The increase in operating expenses was due primarily to higher selling and general and administrative expense as the Company continues to grow our capacity to deliver on the sales backlog, slightly offset by lower research and development costs in the 2025 fiscal third quarter compared to the 2024 fiscal third quarter.

Fiscal 2025 First Three Quarters Results of Operations

Net Income (Loss)

Net income was $5.5 million, or $0.30 earnings per diluted share, in the 2025 fiscal first three quarters, compared to net loss of ($1.0) million during the 2024 fiscal first three quarters, equating to a ($0.09) loss per diluted share. The $6.5 million favorable variance is due primarily to a $17.0 million increase in net sales and a 5.6% improvement in gross profit margin percentage.

Net Sales

Net sales in the 2025 fiscal first three quarters were $43.8 million, an increase of $17.0 million, or 63.0%, compared to 2024 fiscal first three quarters net sales of $26.9 million. The increase in net sales was driven by a $9.5 million, or 76.6%, increase in aeromedical training solutions, a $6.0 million, or 63.0% increase in sterilizer systems, $0.6 million, or 50.4% increase in environmental testing and simulation systems, and a $0.7 million, or 75.4% increase in service and spare parts net sales in 2025 fiscal first three quarters as compared to 2024 fiscal first three quarters. Bookings in the 2025 fiscal first three quarters were $37.2 million as compared to $37.3 million in the 2024 fiscal first three quarters. Bookings in the 2025 fiscal first three quarters were driven by $14.6 million of Aerospace Solutions orders and $22.6 million of Commercial/Industrial Systems orders.

Gross Profit

Gross profit for the 2025 fiscal first three quarters was $13.8 million compared to $7.0 million in the 2024 fiscal first three quarters, an increase of $6.9 million, or 98.6%. The increase in gross profit was due to an increase in net sales and improved gross margin percentage of 5.6% from 25.9% in the 2024 fiscal first three quarters to 31.5% in the 2025 fiscal first three quarters.

Operating Expenses

Operating expenses, including sales and marketing, general and administrative, and research and development, for the 2025 fiscal first three quarters were $7.6 million, an increase of $0.6 million, or 8.8%, compared to $7.0 million for the 2024 fiscal first three quarters. The increase in operating expenses was primarily due to increased selling and general and administrative expenses related to higher sales and personnel expense related to growth in operations as the Company continues to grow our capacity to deliver on the sales backlog.

Cash Flows from Operating, Investing, and Financing Activities

During the 2025 fiscal first three quarters, the Company used $4.5 million of cash from operating activities, due primarily to an increase in contract assets and a decrease in contract liabilities, slightly offset by an increase in net income, a decrease in accounts receivable and prepaid expenses and other assets, as compared to using $6.0 million during the 2024 fiscal first three quarters.

Cash used for investing activities was $0.3 million during the 2025 fiscal first three quarters which primarily related to funds used for capital expenditures of equipment and software development as compared to $0.2 million used for investing activities during the fiscal first three quarters of 2024.

The Company’s financing activities included borrowings of $4.0 million during the fiscal first three quarters of 2025 under the Company’s credit facilities as compared to borrowing of $4.3 million during the 2024 fiscal first three quarters under the Company’s credit facilities.

Financial Table Follows

Forward-looking Statements

This news release contains forward-looking statements, which are based on management's expectations and are subject to uncertainties and changes in circumstances. Words and expressions reflecting something other than historical fact are intended to identify forward-looking statements, and these statements may include terminology such as "may", "will", "should", "expect", "plan", "anticipate", "believe", "estimate", "future", "predict", "potential", "intend", or "continue", and similar expressions. We base our forward-looking statements on our current expectations and projections about future events or future financial performance. Our forward-looking statements are subject to known and unknown risks, uncertainties and assumptions about ETC and its subsidiaries that may cause actual results to be materially different from any future results implied by these forward-looking statements. We caution you not to place undue reliance on these forward-looking statements.