ETC Announces Fiscal 2020 Full Year and Fourth Quarter Results

SOUTHAMPTON, PA, USA, January 8, 2021 – Environmental Tectonics Corporation (OTC Pink: ETCC) (“ETC” or the “Company”) today reported its financial results for the fifty-three week period ended February 28, 2020 (“fiscal 2020”) and the thirteen week period ended February 28, 2020 (the “2020 fourth quarter”).

Robert L. Laurent, Jr., ETC’s Chief Executive Officer and President stated, “Fiscal 2020 was a challenging year as future projects were delayed and that challenge continued as ETC entered fiscal 2021 in the early stages of a global pandemic. ETC has remained open throughout, continues to develop products in each of its business units, and is working diligently with its customers to convert a solid pipeline into purchase orders.”

Fiscal 2020 Results of Operations

Bookings / Sales Backlog

Bookings in fiscal 2020 were $15.5 million, leaving our sales backlog as of February 28, 2020, which represents the sales we expect to recognize for our products and services for which control has not yet transferred to the customer, at $17.1 million compared to $42.2 million as of February 22, 2019. We expect to recognize approximately 83% of the total sales backlog as of February 28, 2020 over the next twelve (12) months and approximately 87% over the next twenty-four (24) months as revenue, with the remainder recognized thereafter. Of the February 28, 2020 sales backlog, $12.1 million, or 70.5%, pertains to International contracts within the Aerospace segment.

Bookings / Sales Backlog

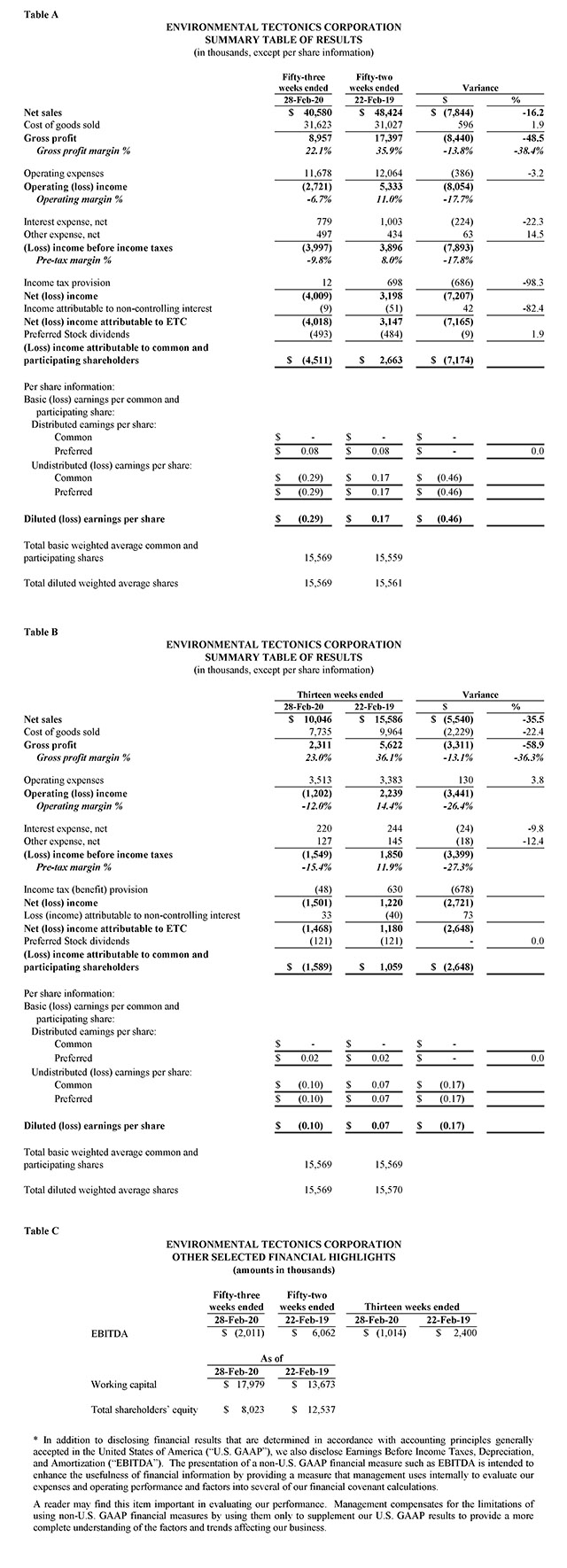

Net (loss) attributable to ETC was $4.0 million, or $0.29 diluted loss per share, in fiscal 2020, compared to $3.1 million during fiscal 2019, equating to $0.17 diluted earnings per share. The $7.1 million variance is due to the combined effect of an $8.4 million decrease in gross profit, offset, in part, by a $0.7 million decrease in income tax provision, a $0.4 million decrease in operating expenses, and a $0.2 million decrease in interest expense.

Net Sales

Net sales for fiscal 2020 were $40.6 million, a decrease of $7.8 million, or 16.2%, compared to fiscal 2019 net sales of $48.4 million. The decrease reflects lower International sales within Aeromedical Training Solutions and of Sterilizers to Domestic customers, offset, in part, by an increase in International sales within the Sterilizers and Environmental business units of our CIS segment.

Gross Profit

Gross profit for fiscal 2020 was $9.0 million compared to $17.4 million in fiscal 2019, a decrease of $8.4 million, or 48.2%. The decrease in gross profit was due to the combination of lower net sales and a lower blended gross profit margin as a percentage of net sales, which decreased to 22.1% in fiscal 2020 compared to 35.9% in fiscal 2019. The decrease in gross profit margin as a percentage of net sales was due to the completion and delivery of two (2) significant International ATS contracts during fiscal 2019, which resulted in the Company entering fiscal 2020 with a lower backlog comprised of contracts with comparably lower estimated profit booking rates, coupled with increases in the estimated total costs to fulfill performance obligations associated with several contracts, which resulted in a reduction to the profit booking rates. The shift in concentration of net sales from International sales within the Aerospace segment in fiscal 2019 to sales within the CIS segment in fiscal 2020 also contributed to the decrease in gross profit margin as a percentage of net sales.

Operating Expenses

Operating expenses, including sales and marketing, general and administrative, and research and development, for fiscal 2019 were $11.6 million, a decrease of $0.4 million, or 3.2%, compared to $12.0 million for fiscal 2019. The decrease in operating expenses was due primarily to a reduction in selling and marketing expenses related to a decrease in commission expense based on a lower concentration of International sales related to ATS products, and a reduction in headcount of four (4) employees who were committed to sales and marketing functions. This decrease was offset, in part, by an increase in research and development expenses as a result of a lower backlog and more research and development employees being assigned to development projects versus customer contracts; thus, expenses related to these employees were excluded from cost of sales in fiscal 2020. The most noteworthy of these development projects being a new general aviation trainer – the GAT-III Fixed Wing Aviation Trainer, which includes significant improvements and technological upgrades over its predecessor – the GAT-II. Most of the Company’s research and development efforts, which were and continue to be a significant cost of its business, are included in cost of sales for applied research for specific contracts, as well as research for feasibility and technology updates.

Interest Expense, Net

Interest expense, net, for fiscal 2020 was $0.8 million compared to $1.0 million in fiscal 2019, a decrease of $0.2 million, or 22.3%, due to the combination of an overall lower level of bank borrowing and a decrease in interest rates.

Other Expense, Net

Other expense, net, for fiscal 2020 was $0.5 million compared to $0.4 million in fiscal 2019, an increase of $0.1 million, or 14.3%, due primarily to the net effect of assets related to monoplace chambers being written off against the value of the asset purchase agreement. Other expense, net generally consists of bank and letter of credit fees, as well as realized foreign currency exchange gains and losses.

Income Taxes

As of February 28, 2020, the Company reviewed the components of its deferred tax assets and determined, based upon all available information, that it is more likely than not that deferred tax assets relating to its federal and state net operating loss (“NOL”) carryforwards and research and development tax credits will not be realized primarily due to uncertainties related to our ability to utilize them before they expire. Accordingly, we have established a $6.8 million valuation allowance for such deferred tax assets that we do not expect to realize. If there is a change in our ability to realize our deferred tax assets for which a valuation allowance has been established, then our tax valuation allowance may decrease in the period in which we determine that realization is more likely than not.

An income tax provision of $12 thousand was recorded in fiscal 2020 compared to an income tax provision of $0.7 million recorded in fiscal 2019. Effective tax rates were -0.3% and 17.9% for fiscal 2020 and fiscal 2019, respectively. The decrease in the effective tax rate for fiscal 2020 as compared to fiscal 2019 was driven primarily by the operating loss incurred in fiscal 2020 and the offsetting valuation allowance that was recorded against the increase in deferred tax assets relating primarily to federal NOL carryforwards.

Fiscal 2020 Fourth Quarter Results of Operations

Net (Loss) Income Attributable to ETC

Net (loss) attributable to ETC was $1.5 million, or $0.10 diluted loss per share, in the 2020 fourth quarter, compared to $1.2 million during the 2019 fourth quarter, equating to $0.07 diluted earnings per share. The $2.7 million variance is due to the combined effect of a $3.3 million decrease in gross profit and a $0.1 million increase in operating expenses, offset, in part, by a $0.7 million decrease in income taxes.

Net Sales

Net sales for the 2020 fourth quarter were $10.0 million, a decrease of $5.6 million, or 35.5%, compared to net sales of $15.6 million for the 2019 fourth quarter. The decrease reflects lower International sales within Aeromedical Training Solutions and of Sterilizers to Domestic customers and monoplace chambers to International customers, offset, in part, by an increase in overall sales within the Environmental and Service and Spares business units of our CIS segment.

Gross Profit

Gross profit for the 2020 fourth quarter decreased by $3.3 million, or 58.9%, compared to the 2019 fourth quarter. The decrease in gross profit was due to the combination of lower net sales and a lower blended gross profit margin as a percentage of net sales, which decreased to 23.0% in the 2020 fourth quarter compared to 36.1% in the 2019 fourth quarter. The decrease in gross profit margin as a percentage of net sales was due to the completion and delivery of two (2)

significant International ATS contracts during fiscal 2019, which resulted in the Company entering fiscal 2020 with a lower backlog comprised of contracts with comparably lower estimated profit booking rates, coupled with increases in the estimated total costs to fulfill performance obligations associated with several contracts, which resulted in a reduction to the profit booking rates. The shift in concentration of net sales from International sales within the Aerospace segment in fiscal 2019 to sales within the CIS segment in fiscal 2020 also contributed to the decrease in gross profit margin as a percentage of net sales.

Operating Expenses

Operating expenses, including sales and marketing, general and administrative, and research and development, for the 2020 fourth quarter were $3.5 million, an increase of $0.1 million, or 3.8%, compared to $3.4 million for the 2019 fourth quarter. The slight increase in operating expenses was due primarily to an increase in research and development expenses as a result of a lower backlog and more research and development employees being assigned to development projects versus customer contracts, and an increase in general and administrative expenses at ETC-PZL, offset, in part, by a reduction in selling and marketing expenses related to a decrease in commission expense based on a lower concentration of International sales related to ATS products, and a reduction in headcount of four (4) employees who were committed to sales and marketing functions.

Interest Expense, Net

Interest expense, net, for both the 2020 fourth quarter and the 2019 fourth quarter was $0.2 million.

Other Expense, Net

Other expense, net, which is comprised of primarily realized foreign currency exchange gains and losses and letter of credit fees, was $0.1 million for both the 2020 fourth quarter and the 2019 fourth quarter.

Income Taxes

An income tax benefit of $48 thousand was recorded in the 2020 fourth quarter compared to an income tax provision of $0.6 million recorded in the 2019 fourth quarter. Effective tax rates were 3.1% and 34.1% for the 2020 fourth quarter and the 2019 fourth quarter, respectively. The decrease in the effective tax rate for the 2020 fourth quarter as compared to the 2019 fourth quarter was driven primarily by the operating loss incurred in the 2020 fourth quarter and the offsetting valuation allowance that was recorded against the increase in deferred tax assets relating primarily to federal NOL carryforwards.

Liquidity and Capital Resources

As of February 28, 2020, the Company’s availability under the Revolving Line of Credit was $2.2 million. This reflected cash borrowings of $20.1 million and net outstanding standby letters of credit not covered by the Committed Line of Credit of approximately $2.7 million. As of January 5, 2021, the date of our most current Revolving Line of Credit statement, the Company’s availability under the Revolving Line of Credit was approximately $3.6 million. The Company had working capital of $18.6 million as of February 28, 2020 compared to working capital of $13.7 million as of February 22, 2019. The increase in working capital was primarily the result of an increase in accounts receivable. With unused availability under the Company’s various current lines of credit, the conversion of contract assets into cash, the collection of milestone payments associated with several International contracts, and expected deposits on fiscal 2021 bookings, the Company anticipates its sources of liquidity will be sufficient to fund its operating activities, anticipated capital expenditures, and debt repayment obligations throughout fiscal 2021.

Cash flows from operating activities

During fiscal 2020, due primarily from the net losses incurred, the increase in accounts receivable and contract assets, and the decrease in contract liabilities, offset, in part, by the increase in accounts payable and other accrued liabilities, the Company used $9.3 million of cash for operating activities compared to generating $13.3 million in fiscal 2019.

Cash flows from investing activities

Cash used for investing activities primarily relates to funds used for capital expenditures in property, plant, and equipment and software development. The Company’s fiscal 2020 and fiscal 2019 investing activities used $0.3 million, which consisted primarily of equipment and software enhancements for our ATFS and ADMS technologies, and costs to upgrade existing information technology systems and enhance our manufacturing and ETSS testing capabilities.

Cash flows from financing activities

During fiscal 2020, the Company’s financing activities provided $7.7 million of cash from borrowings under the Company’s various lines of credit. During fiscal 2019, the Company’s financing activities used $8.5 million of cash for repayments under the Company’s various lines of credit.

Financial Tables Follow

Forward-looking Statements

This news release contains forward-looking statements, which are based on management's expectations and are subject to uncertainties and changes in circumstances. Words and expressions reflecting something other than historical fact are intended to identify forward-looking statements, and these statements may include terminology such as "may", "will", "should", "expect", "plan", "anticipate", "believe", "estimate", "future", "predict", "potential", "intend", or "continue", and similar expressions. We base our forward-looking statements on our current expectations and projections about future events or future financial performance. Our forward-looking statements are subject to known and unknown risks, uncertainties and assumptions about ETC and its subsidiaries that may cause actual results to be materially different from any future results implied by these forward-looking statements. We caution you not to place undue reliance on these forward-looking statements.

Latest News

Read More