ETC Announces Fiscal 2017 Full Year and Fourth Quarter Results and Notice of Annual Meeting of Shareholders

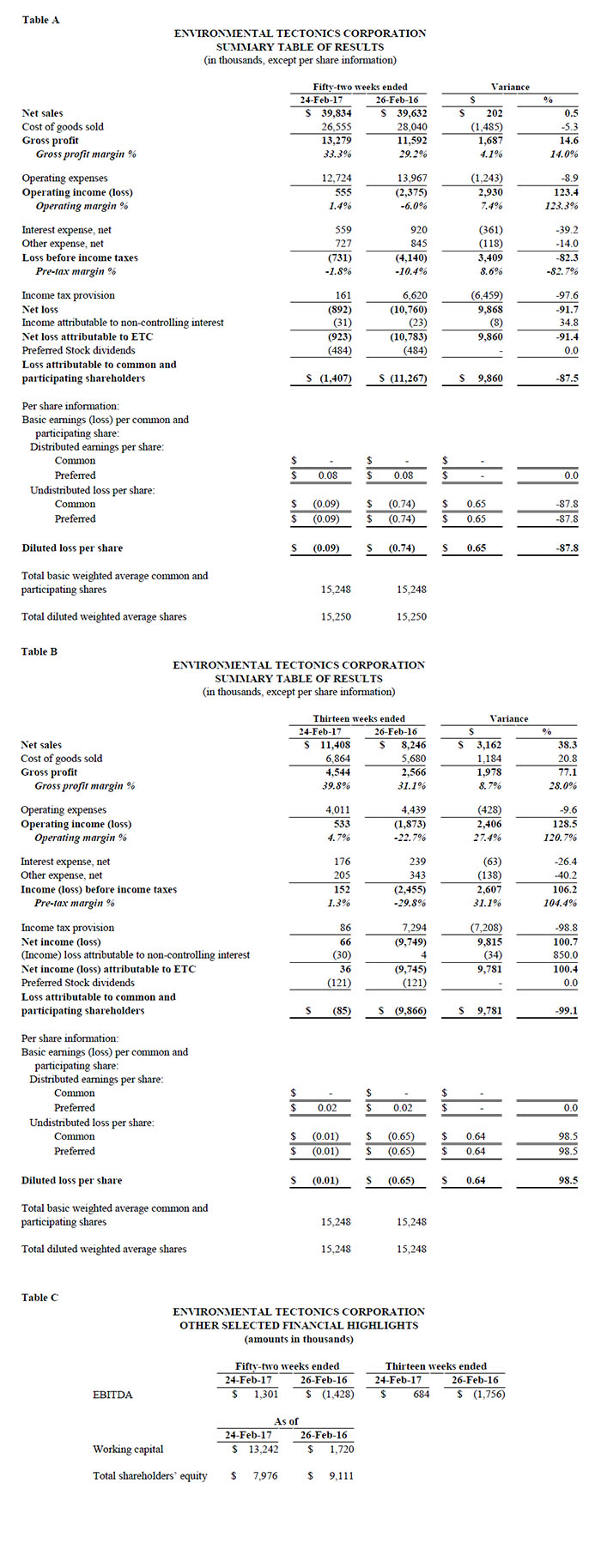

Financial Statement Highlights from Fiscal 2017:

- Gross profit increased 14.6% to $13.3 million

- Operating expenses decreased $1.3 million, or 8.9%

SOUTHAMPTON, PA, USA, May 31, 2017 – Environmental Tectonics Corporation (OTC Pink: ETCC) (“ETC” or the “Company”) today reported its financial results for the fifty-two week period ended February 24, 2017 (“fiscal 2017”) and the thirteen week period ended February 24, 2017 (the “2017 fourth quarter”) and also announced that the Company’s Annual Meeting of Shareholders (the “Annual Meeting”) will be held at The Fuge located at 780 Falcon Circle, Warminster, PA, 18974, USA on Wednesday, July 12, 2017, at 10:00 a.m.

Robert L. Laurent, Jr., ETC’s Chief Executive Officer and President stated, “With an increased backlog of orders for ATS products, ILS contracts, ETC Simulation products, simulator upgrade services and training devices provided by ETC-PZL, environmental test equipment, and sterilizers, and with continued improvement in gross profit and operating margins, we look forward to a solid fiscal 2018.”

Fiscal 2017 Results of Operations

Bookings / Sales Backlog

Bookings in fiscal 2017 were $59.2 million, leaving our sales backlog as of February 24, 2017, for work to be performed and revenue to be recognized under written agreements after such date, at $64.4 million compared to $45.1 million as of February 26, 2016. Of the February 24, 2017 sales backlog, $48.9 million, or 76.0%, pertains to International contracts within the Aerospace segment.

Net Loss Attributable to ETC

Net loss attributable to ETC was $0.9 million, or $0.09 diluted loss per share, in fiscal 2017, compared to a net loss attributable to ETC of $10.8 million during fiscal 2016, equating to $0.74 diluted loss per share. The $9.9 million variance is due to the combined effect of a $6.5 million decrease in the provision for income taxes, a $1.7 million increase in gross profit, a $1.2 million decrease in operating expenses, a $0.4 million decrease in interest expense, and a $0.1 million decrease in other expense.

Net Sales

Net sales for fiscal 2017 were $39.8 million, an increase of $0.2 million, or 0.5%, from fiscal 2016. The increase reflects an increase in sales related to ATS products including Chambers within our Aerospace segment to both International and Domestic customers, and an increase in Domestic sales within the Hyperbaric Chambers business unit of our CIS segment due to consideration (approximately $0.6 million) realized from the termination of a software license, offset, in part, by decreased sales related to ATS products including Chambers and our ADMS line of products within our Aerospace segment to the U.S. Government, and decreased sales of ethylene oxide sterilizers within the Sterilizers business unit of our CIS segment to Domestic customers.

Gross Profit

Gross profit for fiscal 2017 was $13.3 million compared to $11.6 million in fiscal 2016, an increase of $1.7 million, or 14.6%. The increase in gross profit was a combination of a reduction in the amount of additional work required on three contracts and a higher concentration of net sales from more off-the-shelf type products requiring less initial design and engineering work. Gross profit margin as a percentage of net sales increased to 33.3% in fiscal 2017 compared to 29.2% in fiscal 2016.

Operating Expenses

Operating expenses, including sales and marketing, general and administrative, and research and development, for fiscal 2017 were $12.7 million, a decrease of $1.3 million, or 8.9%, compared to $14.0 million for fiscal 2016. This decrease is the combined result of the absence of a one-time severance charge that occurred in fiscal 2016, a decrease in the allowance for doubtful accounts related to the recovery of a long overdue International receivable as compared to the write-off of a receivable deemed to be uncollectable in fiscal 2016, and an on-going effort to reduce non-revenue generating expenses such as an approximately 6% reduction in headcount over the past two fiscal years and a reduction in travel and entertainment and tradeshow and advertising related expenses, offset, in part, by an increase in commissions expense as the concentration of net sales shifts away from U.S. Government.

Interest Expense, Net

Interest expense, net, for fiscal 2017 was $0.5 million compared to $0.9 million in fiscal 2016, a decrease of $0.4 million, or 39.2%, due to the combination of an increase in interest income associated with a two decade old receivable, and a decrease in interest expense due to the combination of a lower level of bank borrowing throughout fiscal 2017 as a whole compared to fiscal 2016 and a decreased interest rate.

Other Expense, Net

Other expense, net, for fiscal 2017 was $0.7 million compared to $0.8 million in fiscal 2016, a decrease of $0.1 million, or 14.0%, due primarily to a decrease in letter of credit fees.

Income Taxes

As of February 24, 2017, the Company reviewed the components of its deferred tax assets and determined, based upon all available information, that it is more likely than not that deferred tax assets relating to its federal and state net operating loss carryforwards will not be realized primarily due to uncertainties related to our ability to utilize them before they expire. Accordingly, we have established a $9.5 million valuation allowance for such deferred tax assets that we do not expect to realize. If there is a change in our ability to realize our deferred tax assets for which a valuation allowance has been established, then our tax valuation allowance may decrease in the period in which we determine that realization is more likely than not.

An income tax provision of $0.2 million was recorded in fiscal 2017 compared to an income tax provision of $6.6 million recorded in fiscal 2016. Effective tax rates were 22.0% and 159.9% for fiscal 2017 and fiscal 2016, respectively. Our effective fiscal 2016 tax rate was significantly higher than fiscal 2017 primarily due to the $7.6 million prior year increase in the aforementioned valuation allowance.

Fiscal 2017 Fourth Quarter Results of Operations

Net Income (Loss) Attributable to ETC

Net income attributable to ETC was $36 thousand, or $0.01 diluted loss per share, in the 2017 fourth quarter, compared to a $9.7 million net loss attributable to ETC during the 2016 fourth quarter, or $0.65 diluted loss per share. The $9.8 million variance is due to the combined effect of a $7.2 million decrease in the provision for income taxes, a $2.0 million increase in gross profit, a $0.4 million decrease in operating expenses, a $0.1 million decrease in interest expense, and a $0.1 million decrease in other expenses.

Net Sales

Net sales for the 2017 fourth quarter were $11.4 million, an increase of $3.1 million, or 38.3%, compared to net sales of $8.3 million for the 2016 fourth quarter. The increase reflects an increase in sales related to ATS products including Chambers within our Aerospace segment to both International and Domestic customers, and an increase in Domestic sales within the Environmental Testing and Simulation Systems (“ETSS”) business unit of our CIS segment, offset, in part, by decreased sales related to ATS products including Chambers and our ADMS line of products within our Aerospace segment to the U.S. Government, and decreased sales of ethylene oxide sterilizers within the Sterilizers business unit of our CIS segment to Domestic customers.

Gross Profit

Gross profit for the 2017 fourth quarter increased by $2.0 million, or 77.1%, compared to the 2016 fourth quarter. The increase in gross profit was a combination of an increase in net sales, a reduction in the amount of additional work required on several contracts, and a higher concentration of net sales from more off-the-shelf type products requiring less initial design and engineering work. Gross profit margin as a percentage of net sales increased to 39.8% in the 2017 fourth quarter compared to 31.1% in the 2016 fourth quarter.

Operating Expenses

Operating expenses, including sales and marketing, general and administrative, and research and development, for the 2017 fourth quarter were $4.0 million, a decrease of $0.4 million, or 9.6%, compared to $4.4 million for the 2016 fourth quarter. This decrease is the combined result of the absence of a one-time severance charge and the write-off of a receivable deemed to be uncollectable, both of which occurred in the 2016 fourth quarter, offset, in part, by an increase in commissions expense as the concentration of net sales shifts away from U.S. Government.

Interest Expense, Net

Interest expense, net, for the 2017 fourth quarter was $176 thousand compared to $239 thousand in the 2016 fourth quarter, a decrease of $63 thousand, or 26.4%, due to a lower level of bank borrowing.

Other Expense, Net

Other expense, net, for the 2017 fourth quarter was $205 thousand compared to $343 thousand in the 2016 fourth quarter, a decrease of $138 thousand, or 40.2%, due to a decrease in realized foreign currency exchange net losses and a decrease in letter of credit fees.

Income Taxes

An income tax provision of $0.1 million was recorded in the 2017 fourth quarter compared to an income tax provision of $7.3 million recorded in the 2016 fourth quarter; a $7.2 million variance due primarily to the $7.6 million prior year increase in the aforementioned valuation allowance and the primary reason for the significant decrease in the effective tax rate of 56.6% for the 2017 fourth quarter compared to 297.1% for the 2016 fourth quarter.

Liquidity and Capital Resources

As of February 24, 2017, the Company’s availability under the Revolving Line of Credit was $2.5 million. This reflected cash borrowings of $17.6 million and net outstanding standby letters of credit not covered by the Committed Line of Credit of approximately $0.9 million. As of May 3, 2017, the date of our most current Revolving Line of Credit statement, the Company’s availability under the Revolving Line of Credit was approximately $2.1 million. The Company had working capital of $13.2 million as of February 24, 2017 compared to working capital of $1.7 million as of February 26, 2016. The increase in working capital was primarily the result of the Revolving Line of Credit being presented as long-term as of February 24, 2017 because of the approximate sixteen (16) month period between February 24, 2017, the current balance sheet date, and June 30, 2018, the current maturity date of the 2016 PNC Credit Facilities, offset, in part, by the net effect of the decrease in costs and estimated earnings in excess of billings on uncompleted long-term contracts and the increase in billings in excess of costs and estimated earning on uncompleted long-term contracts, offset, in part, by the increase in accounts receivable. Under percentage-of-completion revenue recognition, these accounts represent the timing differences of spending on production activities versus the billing and collecting of customer payments.

Cash flows from operating activities

During fiscal 2017, due primarily from the increase in billings in excess of costs and estimated earnings on uncompleted long-term contracts and a decrease in costs and estimated earnings in excess of billings on uncompleted long-term contracts, offset, in part, by the increase in accounts receivable, the Company generated $1.4 million of cash from operating activities compared to generating $6.5 million of cash from operating activities in fiscal 2016.

Cash flows from investing activities

Cash used for investing activities primarily relates to funds used for capital expenditures in property, plant, and equipment and software development. The Company’s fiscal 2017 investing activities used $0.7 million, which consisted primarily of equipment and software enhancements for our ATFS and ADMS technologies and UPRT capabilities, and costs to upgrade existing information technology systems and streamline our engineering and manufacturing processes. This is a decrease of $0.5 million from cash used in investing activities in fiscal 2016.

Cash flows from financing activities

During fiscal 2017, the Company’s financing activities used $1.3 million of cash on payments on the Term Loan, offset, in part, by borrowings under the Company’s various lines of credit and a decrease in restricted cash. During fiscal 2016, the Company’s financing activities used $4.8 million of cash to increase restricted cash and on repayments under the Company’s various lines of credit.

Notice of Annual Meeting of Shareholders

The Annual Meeting will be held at The Fuge located at 780 Falcon Circle, Warminster, PA, 18974, USA on Wednesday, July 12, 2017, at 10:00 a.m. for the following purposes:

- To elect seven (7) Directors to serve on the Board of Directors until ETC’s 2018 Annual Meeting of Shareholders and until their successors are elected.

- To ratify the appointment of RSM US LLP as the independent registered public accounting firm for ETC for the fiscal year ending February 23, 2018.

- To transact such other business as may properly come before the meeting and any adjournment of the meeting.

The Board of Directors has fixed the close of business on May 31, 2017 as the record date for the determination of shareholders entitled to notice of and to vote at the Annual Meeting.

To vote your shares at the Annual Meeting, you or your designated proxy must be present at the Annual Meeting.

A copy of the Company’s 2017 Annual Report is available within the Investors section of ETC’s website at https://www.etcusa.com/investors/shareholder-information/annual-meetingshareholders-materials/.

Financial Tables Below

Forward-looking Statements

This news release contains forward-looking statements, which are based on management's expectations and are subject to uncertainties and changes in circumstances. Words and expressions reflecting something other than historical fact are intended to identify forward-looking statements, and these statements may include terminology such as "may", "will", "should", "expect", "plan", "anticipate", "believe", "estimate", "future", "predict", "potential", "intend", or "continue", and similar expressions. We base our forward-looking statements on our current expectations and projections about future events or future financial performance. Our forward-looking statements are subject to known and unknown risks, uncertainties and assumptions about ETC and its subsidiaries that may cause actual results to be materially different from any future results implied by these forward-looking statements. We caution you not to place undue reliance on these forward-looking statements.