ETC Announces Fiscal 2015 Second Quarter Results and Financial Restructuring to Increase its Capacity to Issue Standby Letters of Credit in Conjunction with Several Recent Significant Orders

SOUTHAMPTON, PA, USA, November 14, 2014 – Environmental Tectonics Corporation (OTC Pink: ETCC) (“ETC” or the “Company”) today reported its financial results for its fiscal 2015 second quarter ended August 29, 2014 (the “2015 second quarter”) and the twenty-six week period ended August 29, 2014 (the “2015 first half”).

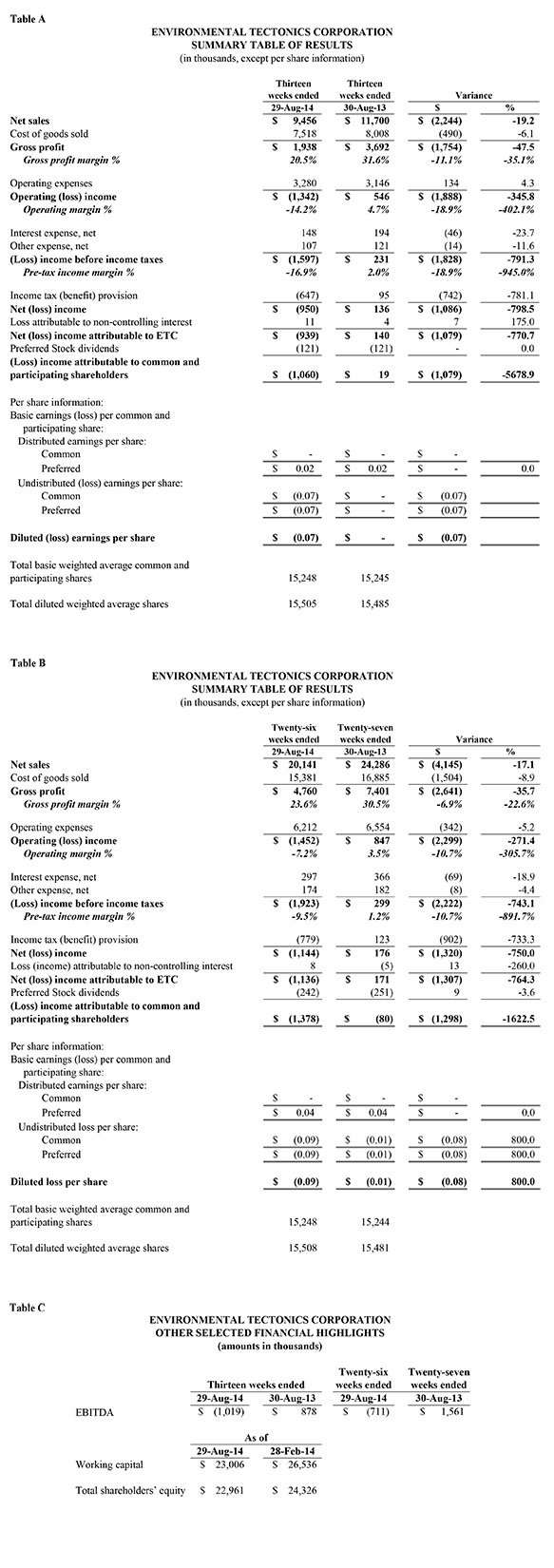

Fiscal 2015 Second Quarter Results of Operations

Net (Loss) Income Attributable to ETC

Net loss attributable to ETC was $939 thousand, or $0.07 diluted loss per share, in the 2015 second quarter, compared to $140 thousand of net income attributable to ETC during its fiscal 2014 second quarter ended August 30, 2013 (the “2014 second quarter”), equating to a $0.00 diluted earnings per share. The $1.1 million variance reflects a decrease in income before income taxes of $1.8 million due almost entirely to a decrease in gross profit, resulting from a combination of both lower net sales and lower gross profit margin percentage, as well as a slight increase in sales and marketing expenses. The $1.8 million decrease in income before income taxes was offset, in part, by a $0.7 million variance between the income tax benefit recorded in the 2015 second quarter and the income tax expense recorded in the 2014 second quarter.

Net Sales

Net sales in the 2015 second quarter were $9.5 million, a decrease of $2.2 million, or 19.2%, compared to 2014 second quarter net sales of $11.7 million. The reduction reflects decreased ATS sales to the U.S. Government and International customers, and decreased sales of monoplace chambers to both Domestic and International customers, offset in part, by increased sales of our other Commercial/Industrial products to Domestic customers. Given the current progress made on U.S. Government contracts in the Company’s sales backlog, the Company anticipates the concentration of sales to the U.S. Government will continue to lessen in fiscal 2015.

Gross Profit

Gross profit for the 2015 second quarter was $1.9 million compared to $3.7 million in the 2014 second quarter, a decrease of $1.8 million, or 47.5%. The significant decrease in gross profit was a combination of both lower net sales and lower gross profit margin percentage due to inefficiencies as a result of additional work required on several contracts, for which we are currently pursuing recovery. On April 24, 2014, we reached a favorable settlement agreement on the first of these recoveries that partially offset the effects of the additional work. Gross profit margin as a percentage of net sales decreased to 20.5% for the 2015 second quarter compared to 31.6% for the 2014 second quarter.

Operating Expenses

Operating expenses, including sales and marketing, general and administrative, and research and development, for the 2015 second quarter were $3.3 million, an increase of $134 thousand, or 4.3%, compared to $3.1 million for the 2014 second quarter. The increase is primarily the result of a one-time commission paid on a large International ATS contract.

Interest Expense, Net

Interest expense, net, for the 2015 second quarter was $148 thousand compared to $194 thousand in the 2014 second quarter, a decrease of $46 thousand, or 23.7%, due primarily to a lower level of bank borrowing.

Fiscal 2015 First Half Results of Operations

Net (Loss) Income Attributable to ETC

Net loss attributable to ETC was $1.1 million, or $0.09 diluted loss per share, in the 2015 first half, compared to $0.2 million of net income attributable to ETC during the twenty-seven weeks ended August 30, 2013 (the “2014 first half”), equating to a $0.01 diluted loss per share. The $1.3 million variance reflects a decrease in income before income taxes of $2.2 million due primarily to a $2.6 million decrease in gross profit, resulting from a combination of both lower net sales and lower gross profit margin percentage, offset in part, by a $0.4 million decrease in operating expenses, resulting from an on-going effort to reduce non-revenue generating expenses. The $2.2 million decrease in income before income taxes was offset, in part, by a $0.9 million variance between the income tax benefit recorded in the 2015 first half and the income tax expense recorded in the 2014 first half.

Net Sales

Net sales in the 2015 first half were $20.1 million, a decrease of $4.2 million, or 17.1%, compared to 2014 first half net sales of $24.3 million. The reduction reflects decreased ATS sales to the U.S. Government and International customers, decreased sales of monoplace chambers to both Domestic and International customers, and decreased sales of Sterilization Systems to International customers, offset in part, by increased sales of Sterilization Systems and Environmental Testing and Simulation Systems to Domestic customers. Given the current progress made on U.S. Government contracts in the Company’s sales backlog, the Company anticipates the concentration of sales to the U.S. Government will continue to lessen in fiscal 2015.

Gross Profit

Gross profit for the 2015 first half was $4.8 million compared to $7.4 million in the 2014 first half, a decrease of $2.6 million, or 35.7%. The significant decrease in gross profit was a combination of both lower net sales and lower gross profit margin percentage due to inefficiencies as a result of additional work required on several contracts, for which we are currently pursuing recovery. On April 24, 2014, we reached a favorable settlement agreement on the first of these recoveries that partially offset the effects of the additional work. Gross profit margin as a percentage of net sales decreased to 23.6% for the 2015 first half compared to 30.5% for the 2014 first half.

Operating Expenses

Operating expenses, including sales and marketing, general and administrative, and research and development, for the 2015 first half were $6.2 million, a decrease of $0.4 million, or 5.2%, compared to $6.6 million for the 2014 first half. The decrease is primarily the result of an on-going effort to reduce non-revenue generating expenses, offset in part, by a one-time commission paid on a large International ATS contract and an increase in legal fees associated primarily with the aforementioned recovery effort.

Interest Expense, Net

Interest expense, net, for the 2015 first half was $297 thousand compared to $366 thousand in the 2014 first half, a decrease of $69 thousand, or 18.9%, due primarily to a lower level of bank borrowing.

Cash Flows from Operating, Investing, and Financing Activities

During the 2015 first half, as a result of a decrease in accounts receivable and costs and estimated earnings in excess of billings on uncompleted long-term percentage of completion (“POC”) contracts, the Company generated $1.5 million of cash from operating activities compared to $3.5 million of cash used in operating activities during the 2014 first half. Under POC revenue recognition, these accounts represent the timing differences of spending on production activities versus the collecting of customer payments.

Cash used for investing activities primarily relates to funds used for capital expenditures of equipment and software development. The Company’s investing activities used $0.7 million in the 2015 first half compared to $0.6 million in the 2014 first half.

The Company’s financing activities used $1.3 million of cash in the 2015 first half, which primarily reflected payments on the Term Loan, and was offset, in part, by a decrease in restricted cash. In the 2014 first half, net cash provided by financing activities totaled $2.8 million, primarily from borrowings under the Company’s various lines of credit and a decrease in restricted cash, offset in part, by payments on the Term Loan.

Financial Restructuring

On November 5, 2014, the Company entered into an amendment to the September 28, 2012 Loan Agreement that provided for, among other things, the following:

- A new $11.7 million Committed Line of Credit (the “Committed Line of Credit”) under which the Company will cover both its existing $2.1 million in standby letters of credit, as well as future standby letters of credit that will be needed shortly in conjunction with significant orders received since August 29, 2014.

- The Committed Line of Credit will be collateralized by H.F. “Gerry” Lenfest, a major shareholder and Chairman of the Company’s Board of Directors, until such time the Company is in position to pledge its own cash collateral.

- The Company’s existing Line of Credit with PNC Bank was decreased from $15.5 million to $13.5 million; however, $2.1 million of funds deemed to have been restricted as of August 29, 2014 is now considered unrestricted and will be used as working capital.

- No monthly principal payments shall be due and payable on the existing Term Loan from September 29, 2014 through October 27, 2015. Monthly principal payments will commence on October 28, 2015, and continue for each succeeding month thereafter. Interest shall still be payable on a monthly basis, regardless of whether or not any principal payment is due. Any outstanding principal and accrued interest shall be due and payable in full on September 28, 2017, which is the current maturity date.

- The Company received a waiver as of the fiscal quarter ended August 29, 2014 for exceeding the permitted maximum Operating Leverage Ratio and for failing to exceed the permitted minimum Fixed Charge Coverage Ratio. Going forward, ETC must maintain at all times a minimum Consolidated Tangible Net Worth of $20.0 million; further, commencing with the fiscal quarter ending August 28, 2015, ETC must maintain as of the end of each fiscal quarter, an Operating Leverage Ratio not greater than 3.00 to 1 and a Fixed Charge Coverage Ratio of at least 1.00 to 1. This ratio will increase to 1.10 to 1 on November 27, 2015, and will remain at that level at all times thereafter.

- Effective as of the date of this amendment, the interest rate on all PNC Lines of Credit, as well as the Term Loan Note, will be based on the PNC Daily Libor Rate plus a margin of 4.00%.

Forward-looking Statements

This news release contains forward-looking statements, which are based on management's expectations and are subject to uncertainties and changes in circumstances. Words and expressions reflecting something other than historical fact are intended to identify forward-looking statements, and these statements may include terminology such as "may", "will", "should", "expect", "plan", "anticipate", "believe", "estimate", "future", "predict", "potential", "intend", or "continue", and similar expressions. We base our forward-looking statements on our current expectations and projections about future events or future financial performance. Our forward-looking statements are subject to known and unknown risks, uncertainties and assumptions about ETC and its subsidiaries that may cause actual results to be materially different from any future results implied by these forward-looking statements. We caution you not to place undue reliance on these forward-looking statements.